In the eight years with DiligenceVault, there has never been a better time to test the mettle. Coming out of Covid, an uncertain 2022, and a retrenchment plagued 2023 will not be easy for anyone. Users of technology are tasked with the herculean task of balancing daily workload, evaluations of technology, delays in decisions, and shrinking budgets. As a result, the cause and effect relationship for tech adoption could be skewed. While there is no magic roadmap or playbook for 2023, ten interconnected themes below present the industry with an opportunity to think big and bold!

A Year of Systemic Innovation

A restriction in the flow of capital will result in a fundamental change in the way innovation is organized. InvestTech firms need to prioritize now more than ever, propelling themselves towards the highest ROI decisions, which is critical for any innovation to scale. So, 2023 is a year that promises innovation driven by true return and not growth at any cost, very likely giving an advantage to firms with sustainable business models in their DNA.

A Year for High Conviction Decisions

The rate of tech adoption has increased significantly in both enterprise and midmarket segments in our industry. However, 2023 may create some slowdown. Despite budget pressures, giving up on digital transformation will only set firms back. Technology presents a sequence of opportunities to the industry to continue to grow in this environment – may it be from greater efficiency, or better risk management or making better investment decisions. Cutting on technology budgets now, would mean a stressed team, higher risk, greater digital debt, and slower growth in the future. It’s a year to bet on convictions!

A Year of Skyscrapers

With any technology, as users start using it on a daily basis, they learn and start needing more features or changes that increase the depth and often complexity. This is natural in any industry, however building scalable complexity is never easy. Skyscrapers are harder to build than single family houses, and it’s not the same architect who does both well. As InvestTechs also build their defensibility with focus and a continued partnership with its users, sustainable business models will serve as the foundation to build these skyscrapers.

A Year of Delivering Happy Hours

With years of isolation blending into inflation and global war, it’s been a nonstop attack on individual resilience. Small frictions can cause frustration. No one likes to spend time copying and pasting, logging into multiple systems, doing things in 10 clicks when 2 are sufficient, and receiving 15 emails when one will suffice. Simple improvements in technology can have a monumental impact on productivity and overall morale. In 2023, it will be critical to deliver technology with empathy! Making our users time rich, removing decision fatigue, and delivering a delightful implementation experience are paramount for any tech adoption. This responsibility lies with the sales, client success, and product strategy teams at all the InvestTechs, but its importance is amplified in 2023.

A Year of Integration Product Market Fit

For the first time, we are seeing more clients demand integrations as opposed to building tangential functionality. What’s more, InvestTech firms who historically would have always tried to build the functionality, are genuinely interested in integrations. As a firm, we delivered five integrations in 2022, added over 25 more to our integration pipeline, and are prioritizing five integrations right now. This is a fundamental change in thinking that our industry is finally seeing, many thanks to forward thinking technologists, and users who are valuing the depth and expertise of specialized solutions over all-in-one offerings. The industry can breathe a collective sigh of relief as these forces converge and accelerate innovation, with each firm focusing on building their own skyscraper, which will be connected to others with bridges and tunnels!

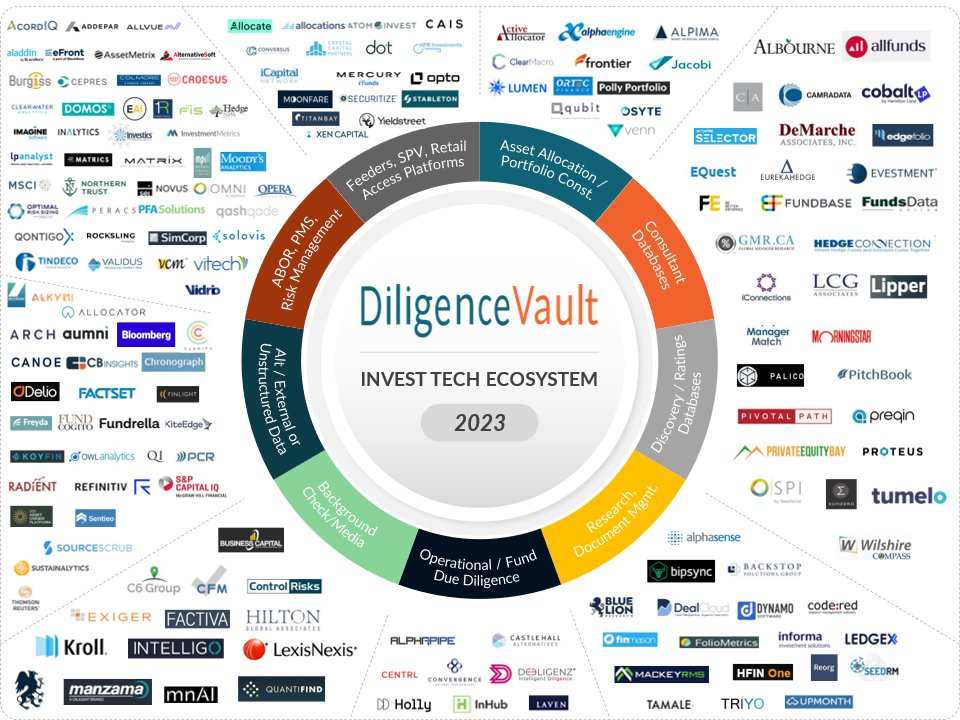

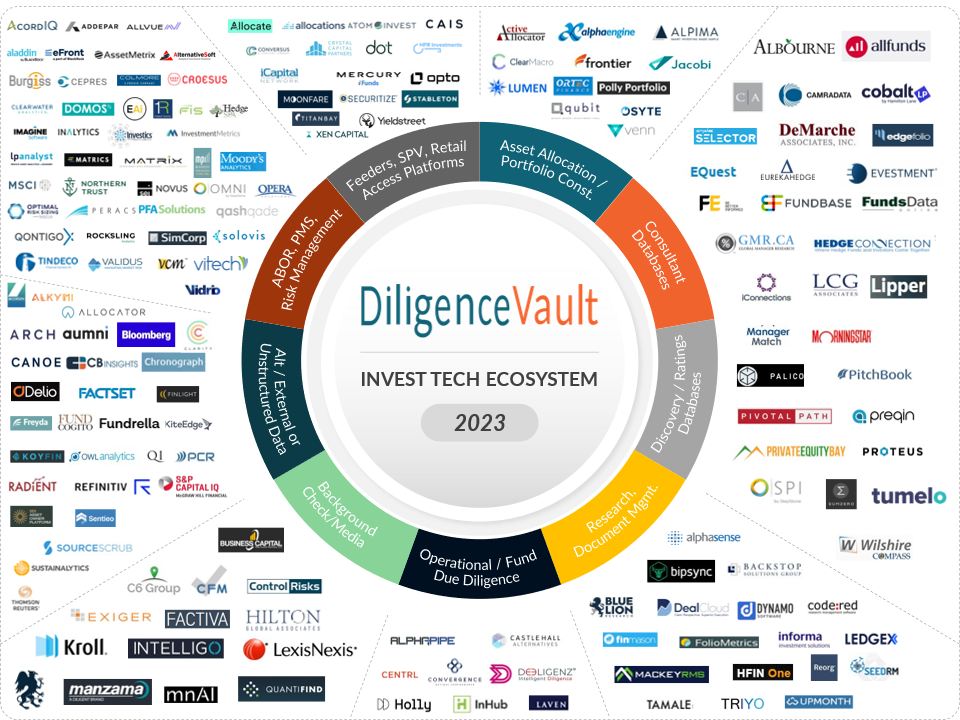

DiligenceVault InvestTech Map 2023

Note: ~20% of the firms have offerings that fit multiple categories, but we have chosen the dominant offering for the classification. Also, you’ll note the absence of digital asset infrastructure, which is a function of our limited knowledge in this space. If experts want to collaborate on that category, please reach out to anna@diligencevault.com

A Year of New InvestTech Launches

There are going to be great InvestTech firms launched in 2023. For all the 2022 and 2023 vintage InvestTechs out there, we share six viewpoints from our experiences:

- Make sure you focus on a scalable business model – a lot of early sales in our industry are based on founder relationships. That doesn’t scale.

- Make sure you understand the pricing. Winning logos is important, but sustainability is also key for long term growth.

- Get nominated for awards, they will help promote your brand. A lot in our industry is self nomination, however, winning awards needs some serious budgets and relationships 😊.

- Clients are demanding – harvest that to make your product better and their experience better. Be mindful of style drift as you meet client demands.

- Focus, focus, and focus in everything you do. Be aware of competitive dynamics, but only focus on things that matter, and things that scale.

- Fundraising is going to be difficult. If you need thoughts on investors who truly understand InvestTech, reach out to us. If you have a founder market fit, it should be rewarded. Keep trying. Your next success is around the corner!

A Year for the First InvestTech Fund

The industry continues to see disproportionate capital flows from strategic investors as opposed to VC/PE backers. For this to change, FinTech venture investing needs a new sector bet – InvestTech.

2022 saw a lot of new launches, M&A, and investing in private capital, themes ranging from:

- Retail and wealth distribution of private capital funds (Allocate, Opto, Securitize joins CAIS, iCapital, Moonfare cohorts),

- Simplifying investor onboarding platform (Anduin, Subscribe+, IDR, Ontra, Wealthblock, fund admins adding technologies), and

- Solutions supporting GP value chain (Asset Class, Figure, Flow, Untap)

All this innovation is happening in the asset class with assets under management (AUM) of ~10 trillion as per McKinsey. If we zoom out, the global AUM is in excess of $100 trillion, and there are a multitude of inefficiencies and innovations that could transform the remaining $90+ trillion in assets being managed as fund investments and mandates, resulting in many $100mm revenue opportunities in the industry. A multi-stage InvestTech fund would bring investor / market fit with deep understanding of the industry dynamics and KPIs, help build InvestTech skyscrapers, and would provide meaningful returns to the LPs, while transforming the very industry they operate in.

A Year of ESG Conviction, and Not Confusion

The ESG segment alone has seen an explosion of ESGTech firms across data collection, analysis, regulatory reporting, exposure computation, proxy voting, engagement tracking and much more. Since 2021, 50+ firms launched across many niches in the ESG investing value chain. The biggest roadblock to winning in this space is a lack of clarity on the path forward. The regulations need to evolve, industry expertise needs to be freely available, and views on what real engagement is needs to converge. There’s an opportunity to build user-driven ESGTech integrations as the entire value chain is innovating simultaneously, backed by a commitment from both asset owners and asset managers, and supported by regulations to drive the industry to a place of clarity.

A Year of Generative AI and New Risks

ChatGPT is a conversation at almost every tech panel and within InvestTech firms. Generative AI presents tremendous opportunities to improve our day-to-day work. ChatGPT has a huge potential to simplify research, due diligence, and analysis amongst several applications in our industry. Microsoft’s recent investment partnership with OpenAI opens new doors for new AI infrastructure and toolsets to be available to the industry. However, with innovation comes risk and responsibility. With this innovation, the new risks that present include risks to intellectual property, as well as the need for controls against the dissemination of non-public information as multiple stakeholders within the firm deploy ChatGPT and other generational AI applications.

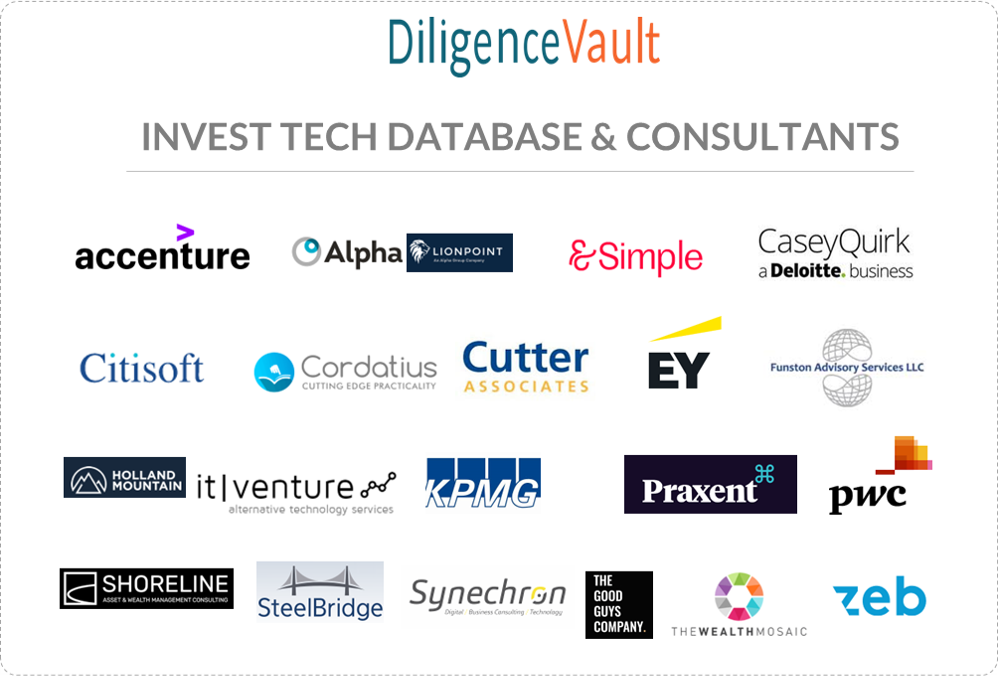

A Year of Implementation Partnerships

2023 is another year where tech implementation partnerships will be critical. Teams are busier, but they need the right tech. The tech ecosystem is evolving, so prioritizing and understanding the marketplace is not easy. Partnering with firms that help with selection and implementation will be a key winning factor.

Some useful resources from firms in this cohort:

● Alpha FMC shares views on Pensions & Retail Investment Outlook for 2023

● PE stack recently merged with Holland Mountain. Their Private Equity Tech Maps which include private capital tech firms for both GPs and LPs are a great industry resource

● Shoreline’s views on Optimizing Asset Management Transformations

2023 – The Big and The Bold

Amazing technology will continue to be delivered in our industry giving tremendous impetus to industry innovation.

InvestTechs that invest resources in truly understanding their users and industry dynamics will be scalable winners and build skyscrapers for the industry. At the same time, InvestTechs need to be BOLD, at the risk of even failing. At DiligenceVault, if we had responded to one set of user feedback alone, we would have built a complex text extraction engine to simplify diligence data extraction from documents and emails and would have missed out on the massive opportunity to create a fundamental behavior shift in our industry by building a global digital infrastructure of over 12,000 firms and supporting over 15 data collection and diligence use cases.

All the ten themes that we discussed are value-generating individually, but their impact on the industry is disruptive when they combine. While this is our viewpoint on InvestTech in 2023, it does feel like we are writing about our DNA and values, and 2023 is a year when our values and DNA converge with the industry in such a BIG way!

Thank you Team DiligenceVault, our clients, industry influencers, and friends for your review in refreshing the 2023 InvestTech map. If you’d like to add your firm to any of the InvestTech, Investor & Backer, or Database & Consultants maps, please email anna@diligencevault.com

Do read about our InvestTech musings since 2017 :).

2022: InvestTech Moments in 2022

2021: The Age of InvestTech

2020: Top 10 Creators of InvestTech Unicorn

2019: And The Next InvestTech Unicorn Is…