Leverage Form ADV regulatory filings for portfolio risk management and fund due diligence

SEC’s Form ADV regulatory filings have data for over 25,000 firms, and over 70,000 private funds. Leverage this rich dataset for:

- Manager sourcing by reviewing new launches and registrations

- Identifying and monitoring key opportunities proactively

- Benchmarking best practices across peer group within your portfolio

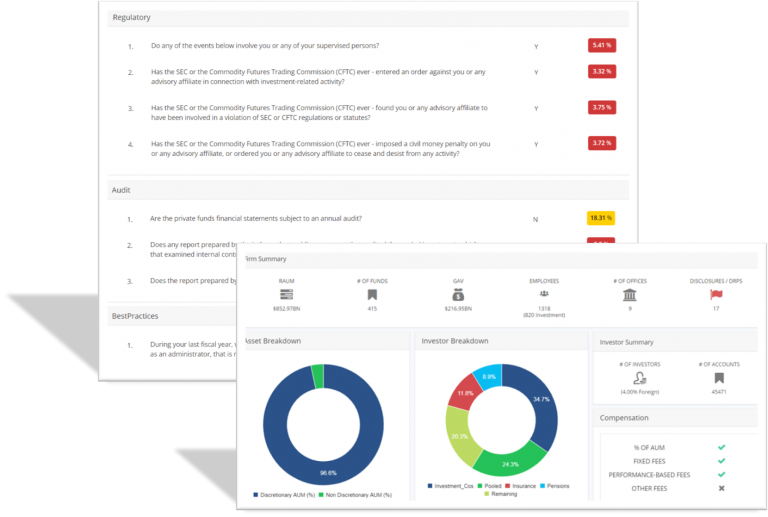

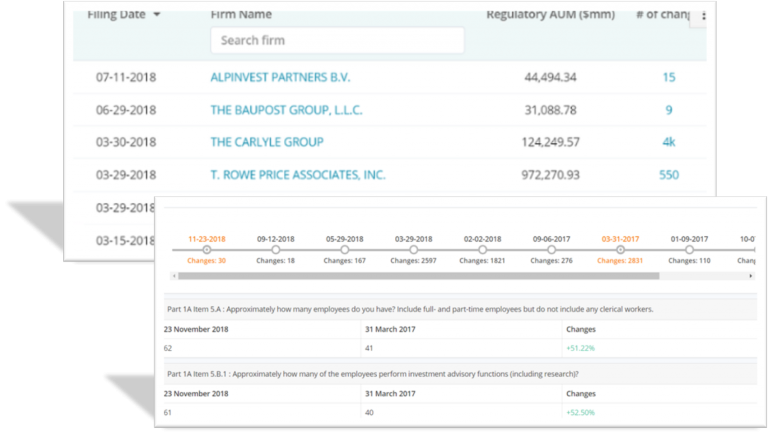

Tired of manually reviewing annual filings in PDF format? Access simple, yet effective advisor profiles, private fund listings, and private fund profiles. Configure materiality threshold for filing changes.

- Track historical changes across regulatory assets, investor profiles

- Monitor changes to headcount, regulatory assets under management (AUM) and gross assets

- Identify new criminal, civil and regulatory DRPs

- Identify changes to key owners and executives as well as service providers including audit firms, prime brokers, custodians and administrators

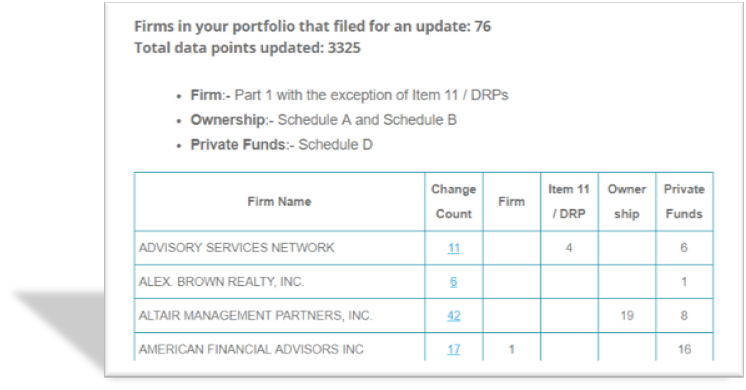

Configure daily / weekly email alert with Form ADV regulatory filing changes of your portfolio delivered to your inbox. Be proactive in identifying and monitoring risks in your portfolio. Track material changes in the Form ADV brochures easily on the platform.

Integrate the power of Form ADV data in your decision making across risk dashboards, investment committee memos, fund factsheets, and integrating with internal fund investments data lake.

- Search the entire database of ADV filings with firm and private fund data filters.

- Gain key insights around filing history, trends in SEC filings, peer benchmarking and more with our ADV Power BI analytics dashboards.

- Create data exports for further analysis and reporting

MORE ADV RESOURCES

Get Data Insights From SEC’s Form ADV Filings

WHITEPAPER: 10 Ways Asset Allocators Are Using Form ADV Dataset

This whitepaper delves into the value of SEC’s Form ADV filings dataset for investors including due diligence and sourcing of private fund investments. Read our whitepaper to learn more.

DOWNLOAD RESOURCE

WHITEPAPER: 10 Ways Asset Managers Are Using Form ADV Data

This whitepaper highlights the different applications of using Form ADV data, mandated by the SEC under the Investment Advisers Act of 1940, and utilized as a vital tool by Asset Managers.

DOWNLOAD RESOURCE

INFOGRAPHIC: Private Markets Data ADV Overview

Take advantage of the asset class specific one-pagers based on the SEC’s FormADV data of private equity, private credit, venture capital, real estate, infrastructure and related strategies.

DOWNLOAD RESOURCE