Consistent ESG reporting is hard to implement in a multi-asset portfolio. There is no clear standard adopted by the industry.

DiligenceVault provides a digital solution that can build a flexible ESG assessment framework.

DIGITAL FIRSTStreamline Your ESG Research

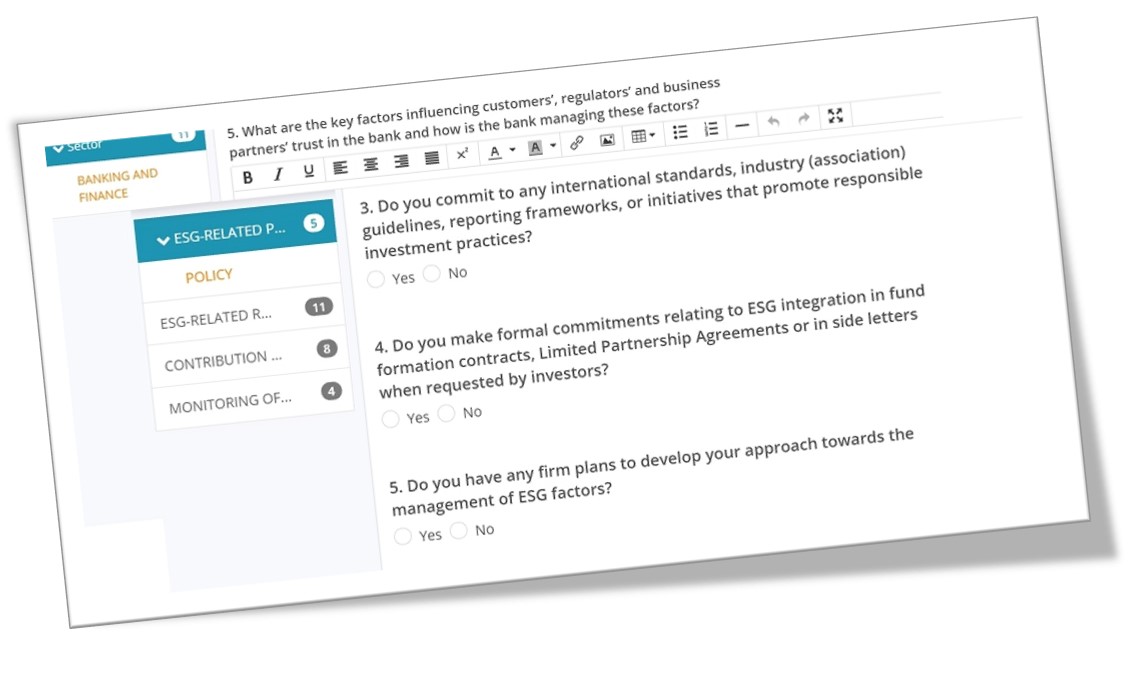

DigitalDiligence is a powerful, yet flexible module that helps you build a consistent framework across your ESG research and monitoring requirements.

- Leverage PRI, InvestEurope digital questionnaires as well as AIMA’s responsible investing and ILPA’s DEI framework.

- Build transparency directly from your external managers and portfolio companies.

COLLABORATION LAYERDelight In Collaboration and Flexibility

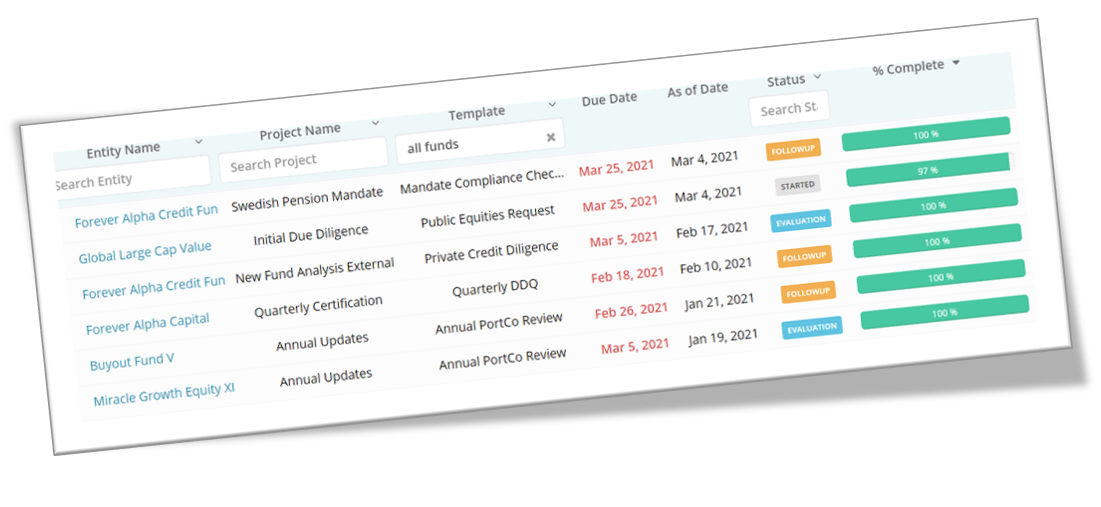

Establish a collaborative process to ingest the right set of information from your direct portfolio company investments as well as public and private markets asset managers.

- Build an institutional review and analysis framework for ESG diligence

- Maintain flexibility in adapting the framework as industry standards converge

TRANSPARENCY & DATA ANALYTICSBuild an analytics layer to drive impact

Create a modern, and user-friendly experience for all stakeholders

- Easily analyze diligence frameworks and benchmark various manager characteristics

- Create heatmaps and provide feedback to the managers on their strengths and weaknesses

- Build dashboards for senior management to evaluate impact potential across the investment portfolio