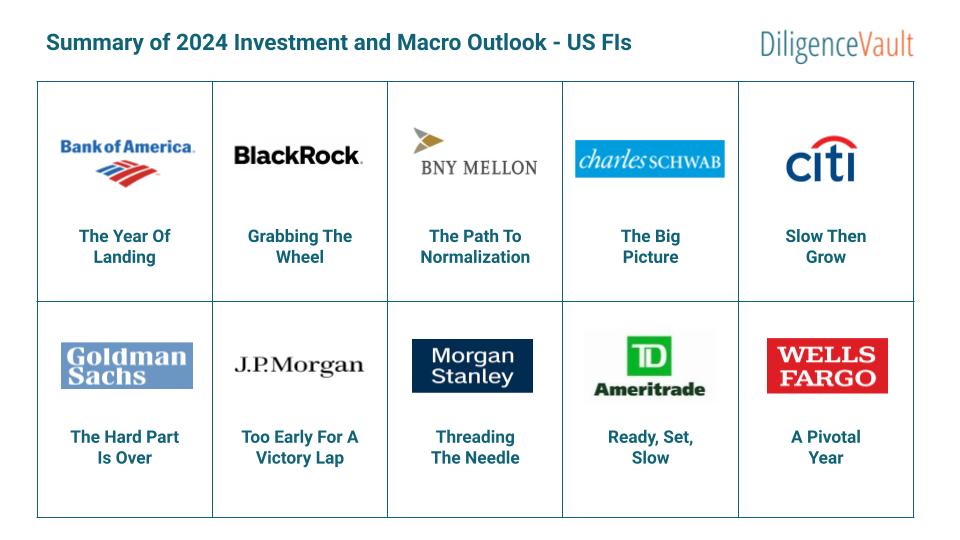

Investment and macro outlooks are important due diligence considerations for fund investors. Each year, financial institutions publish macro and investment outlooks which give insights into their research on global markets, investment cycles, and risk considerations. As we begin 2024, we selected outlooks from a group of 10 banks, asset managers, wealth platforms, and broker dealers and summarized viewpoints for our due diligence clients.

Let’s start with the taglines for the summaries. The financial institutions have created an interesting set of tag lines for their research report with “The Hard Part Is Over” having the most positive sentiment score as compared to the “Too Early For A Victory Lap” being the least positive. However, OpenAI warns that the sentiment of these titles can still vary based on the specific content and context of each article or report.

We further leveraged OpenAI’s ChatGPT to help us analyze the macro and investment outlook for 2024 from 10 US financial institutions. Here’s the summary:

- General Consensus: Expectations of a global economic recovery with some variations

- Volatility: Expectation of elevated volatility

- Inflation and Rate Expectations: Expectations of slowing inflation, leading to potential central bank rate cuts in response to economic conditions

- Equities: Positive outlook with focus on earnings growth, potential for increased volatility

- Bonds: Opportunities in high-yield fixed income due to higher yields

- Regional Differences: Varied outlooks for regions like the U.S., Europe, China, and Japan

- Geopolitical Factors: Consideration of geopolitical tensions impacting markets

- Alternatives: Consideration of alternative investments for diversification

- Active Management: Greater emphasis on active portfolio management due to market volatility

Investment and Macro Views from GS, JPM and MS

To flex more of ChatGPT muscle, we asked for a comparison of outlooks from JP Morgan, Morgan Stanley, and Goldman Sachs.

In summary, both JP Morgan and Goldman Sachs acknowledge the strong performance of the global economy but differ in their views on the timing of rate cuts and the extent of inflationary pressures. JP Morgan is more cautious about the central banks’ ability to control inflation, while Goldman Sachs is optimistic about continued economic growth and limited recession risk. They also have slightly different recommendations for investors, with JP Morgan emphasizing bond yields and targeted alternatives, and Goldman Sachs suggesting a balanced asset mix with a focus on duration in portfolios.

- Both Goldman Sachs and Morgan Stanley acknowledge strong global economic performance in 2023, but Morgan Stanley is more cautious about the potential pitfalls in 2024.

- JP Morgan expresses skepticism about central banks’ ability to control inflation and suggests interest rates could fall later than expected, while Goldman Sachs is optimistic about continued growth and limited recession risk.

- All three firms discuss the importance of monetary policy, but Morgan Stanley emphasizes the need for central banks to balance tightening and easing in 2024.

- Morgan Stanley predicts a “tale of two halves” for equity markets in 2024, with a cautious first half and stronger performance in the second half, whereas Goldman Sachs expects returns in various asset classes to exceed cash throughout the year.

- High-quality fixed income is seen as an opportunity by both Morgan Stanley and Goldman Sachs, but JP Morgan recommends focusing on locking in yields in the bond market.

- While all three firms see some risks in emerging markets, Morgan Stanley suggests they could see a stronger recovery in the second half of 2024, driven by lower rates and a weakening U.S. dollar.

Overall, while all three firms have a generally positive macro-outlook, they have varying degrees of caution and differing recommendations for investors in 2024, particularly regarding the timing of rate cuts and the opportunities in fixed income and equities.

Adding Citi’s Viewpoint to the Mix

Next, we introduced Citi’s viewpoint and prompted to recreate comparison:

- Citi’s view aligns with the notion of a transition period, similar to Goldman Sachs and Morgan Stanley, acknowledging economic shifts.

- All four institutions anticipate continued growth, but Citi’s GDP estimates for 2024 and 2025 are slightly lower than Goldman Sachs and Morgan Stanley’s forecasts.

- Citi’s focus on corporate profit growth aligns with Goldman Sachs’ optimism about earnings growth.

- The expectation of the Fed lowering rates in response to employment concerns is in line with Morgan Stanley’s view of central banks delivering insurance cuts if needed.

- While Citi expects inflation and rates to rise, their projections for 10-year rates are lower than Goldman Sachs’ expectations.

- All institutions share an overall positive outlook, but they vary in their emphasis on specific factors and the timing of economic transitions.

In summary, while there are some differences in emphasis and specific macro and investment outlook projections, Citi’s view aligns with the broader consensus of continued economic growth and a transition period in 2024, similar to the perspectives of Goldman Sachs, JP Morgan, and Morgan Stanley.

Image Generation via DALL-E

After leveraging text LLM, we decided to leverage DALL-E and asked it to create a graphic that summaries the macro and investment outlook. Here’s the result below. While this is not quite the right infographic, it was a fun exercise regardless!

List of Macro and Investment Outlooks for 2024

As we close this analysis, here’s a curated list of macro and investment outlook for your reference:

As we work on introducing private equity firms and non-US FIs outlooks in future series, do you have an interest in collaborating? If yes, please reach out.