Private Equity is in an unusual era with focus on new value creation levels, different fundraising dynamics, focus on dry powder and DPI, emergence of secondaries, impact of Gen AI and many other factors. In this blog, we summarize 12 perspectives from Bain & Company Takeaways – Global Private Equity Report 2024. So let’s get started!

1. EDFD Conundrum – Exits, Distribution, Fundraising, Dry Powder

- Lack of exits is the most pressing problem, driven by rising interest rates, declining growth expectations, buyer hesitancy, and bid-ask between sellers

and buyers on deal valuation - With lack of exits, GPs are left with $3.2 trillion in unsold assets. Buyout backed exits in 2023 saw a 44% decline from 2022

- With slower distributions, LPs are struggling with negative cash flows

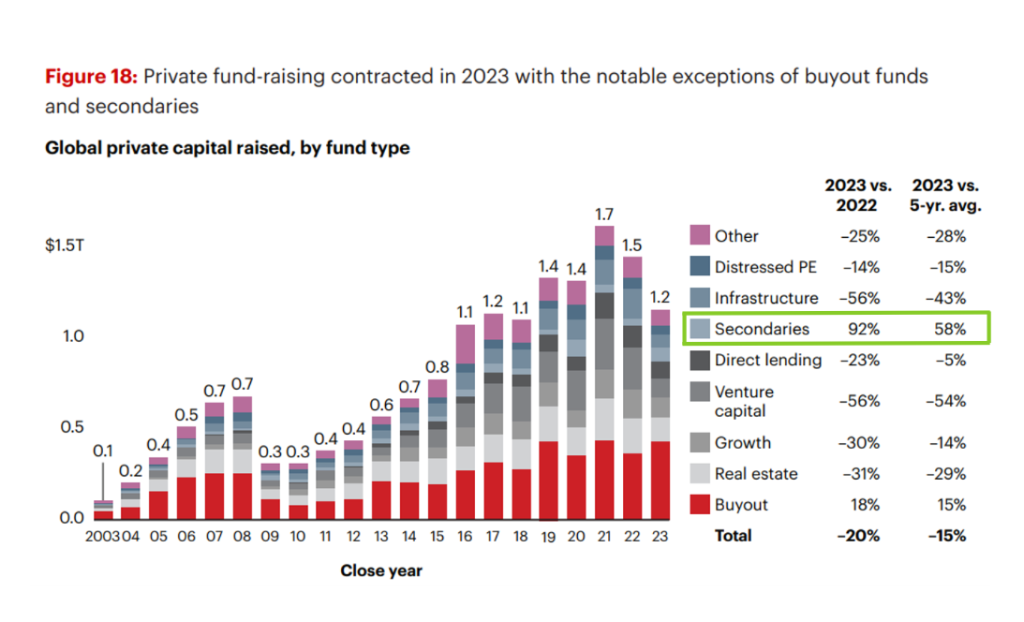

- Fundraising has been difficult, but the industry still raised an impressive $1.2 trillion in fresh capital in 2023

- Dealmaking continued to be slow and deal value declined globally in 2023

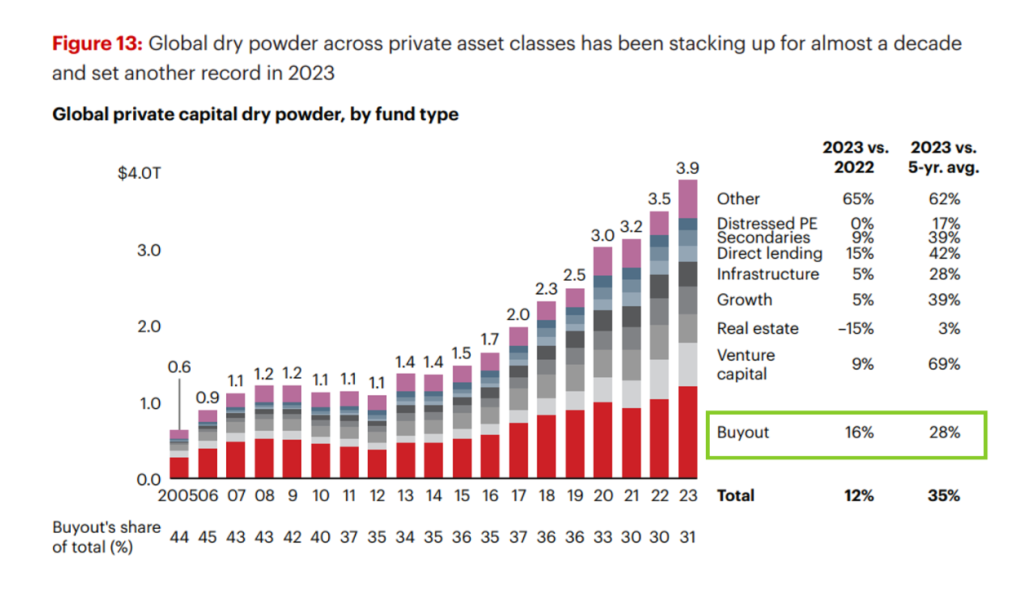

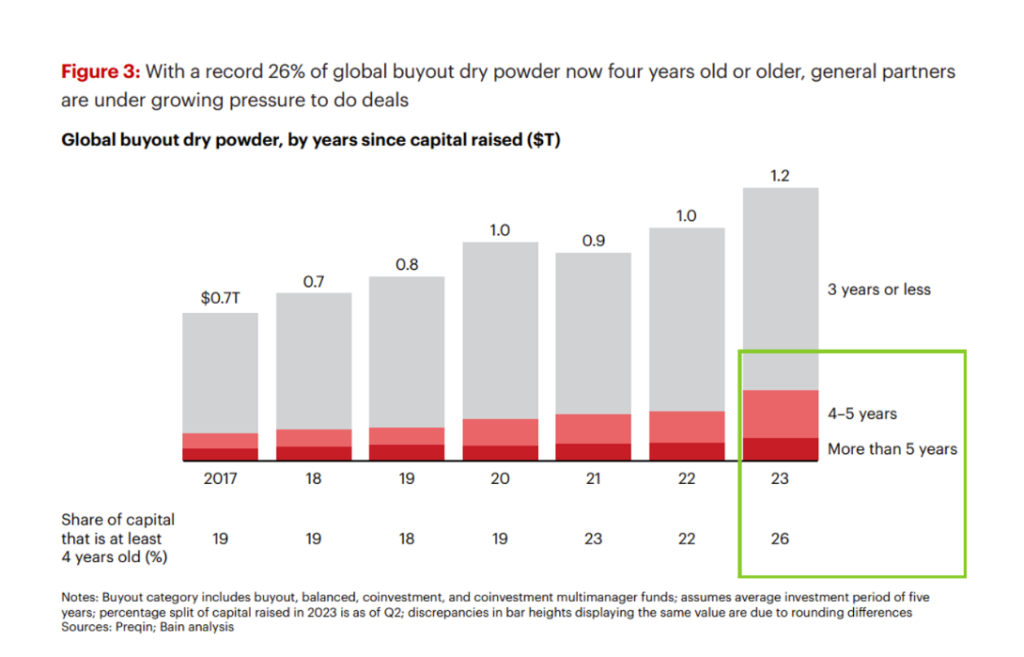

- GPs are sitting on record GP dry power. Buyout GP dry powder is the highest by fund type at $1.2 trillion, but it’s aging! 26% of that is four years old or older, up from 22% in 2022

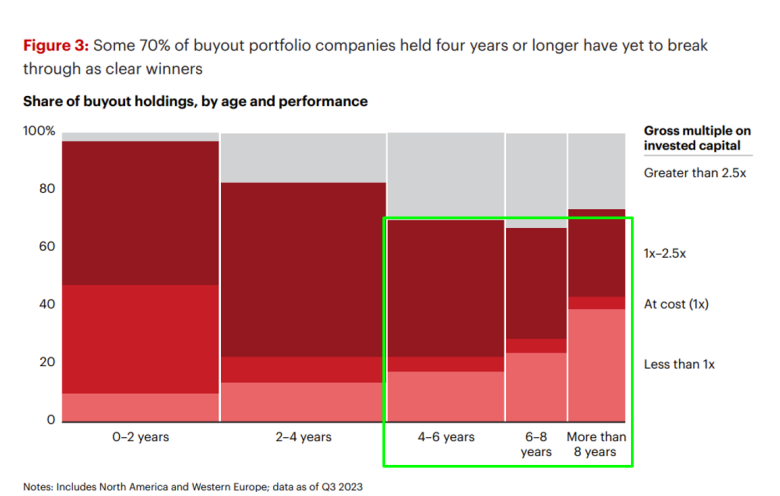

2. It’s The Dark Before The Dawn! Breaking The Logjam

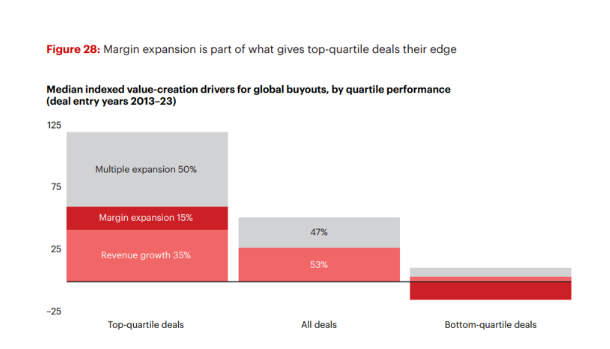

- GPs need robust approaches to value creation, including operating leverage improvements with focused execution to boost EBITDA

- GPs need to deploy organic growth levers – pricing, salesforce effectiveness, and product innovation

- Stabilizing inflation and interest rates are giving more comfort to GPs on the value of and the future growth they are underwriting

- Innovation in liquidity solutions considered by the GPs

- Injecting equity in the PortCo to make debt affordable

- NAV loans at a portfolio level

- Securitize single assets / PortCo

- The secondaries GP fundraising roared ahead by 92% in 2023 providing liquidity alternatives to the industry

3. GPs Professionalizing Fundraising

- Fundraising competition is fierce with 14,500 funds on the road seeking $3.2 trillion in capital as of January 2024, with $1 closed for every $2.40 targeted

- GPs are investing in communication to LPs on how PMs are using all the tools at their disposal to act as a trusted steward of investor capital

- GPs are also honing their go-to-market capabilities. The firms out-raising others are strategically mapping out who their LPs should be and

developing the capabilities and tools necessary to understand what it takes to win with them and expand share of wallet - GPs are building the kind of commercial organizations the best B2B sellers rely on daily. At DiligenceVault we are seeing this trend first hand as private markets GPs are adopting our technology to create their standards DDQs and power their LP due diligences.

4. The PE Appeal – Steady, Long-Term, Diversified Returns

- With Magnificent 7 tech stocks now 28% of the S&P 500 Index, PE funds are playing an increasingly vital role in helping LPs maintain diversification

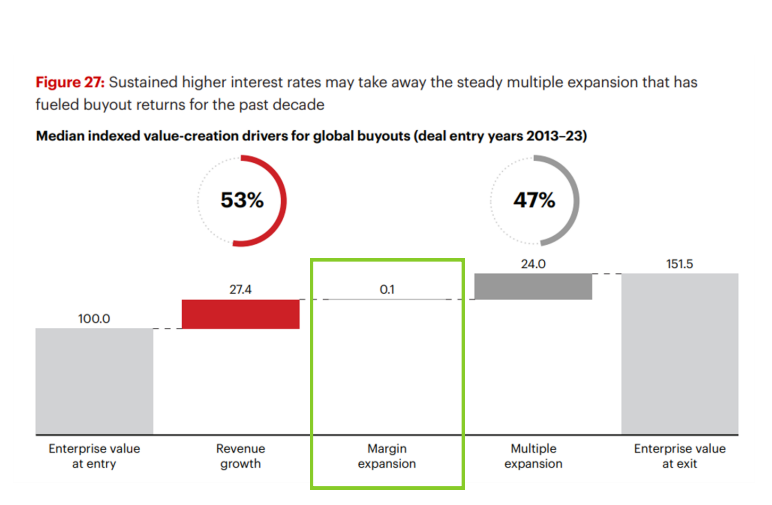

- Margin expansion – an edge for top quartile deals will play a pivotal role in delivering returns in the absence of multiples expansion as a value driver

- Figuring out how to generate performance without those macro tailwinds is what will separate winners and losers in 2024 and beyond

5. The Tipping Point for Secondaries

- LPs have embraced secondaries to rebalance portfolio exposure across strategies, geographies, vintages, and funds

- GPs are using direct secondaries, continuation funds, and “strips” of portfolios to generate liquidity when exit markets sputter

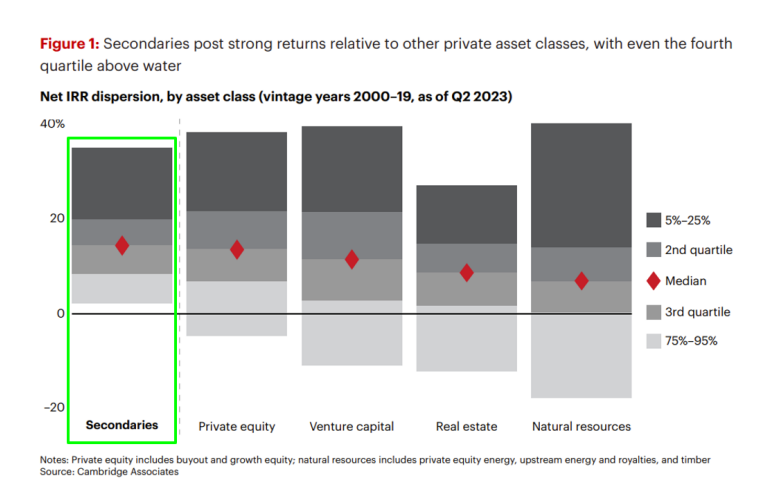

- Secondaries also have a shorter payback period (or J curve) than typical PE investments, and are the only alternative asset class in which even the fourth quartile of funds ekes out a positive return

6. Demand Vs. Scale for Secondary GPs

- Secondary funds typically lack the scale to underwrite sizable transactions on their own, so they tend to recruit other, similar funds to participate in big deals

- Secondary funds can step in to provide liquidity as private capital GPs are looking to tap the wealth segment which is poised to grow from $4 trillion in alternative AUM to $12 trillion

- In the future, secondaries may compete with sponsor-to-sponsor transfer of value as they step in with a continuation vehicle that allows a sponsor to sell off part of a company but maintain control and continue to realize the upside Secondary GPs need to build out infrastructure to scale

7. Exit Story – Credibility With Buyers

With global exits at a 10-year low, it’s safe to say it has rarely been harder to sell a PortCo. For GPs, the time is now to refresh the value-creation plan (or develop a new one) and start showing early results to build credibility.

- Provide evidence of action-driven success during the holding period by linking positive results to specific management initiatives

- Demonstrate that there’s still money on the table by laying out a clear path to future value creation with new sources of value

- Present clear reasons to believe by highlighting how the PortCo has put points on the board with a new plan to accelerate revenue or improve profitability in the years to come

Objective evidence of both past performance and future potential is what will attract and hold a buyer’s attention today.

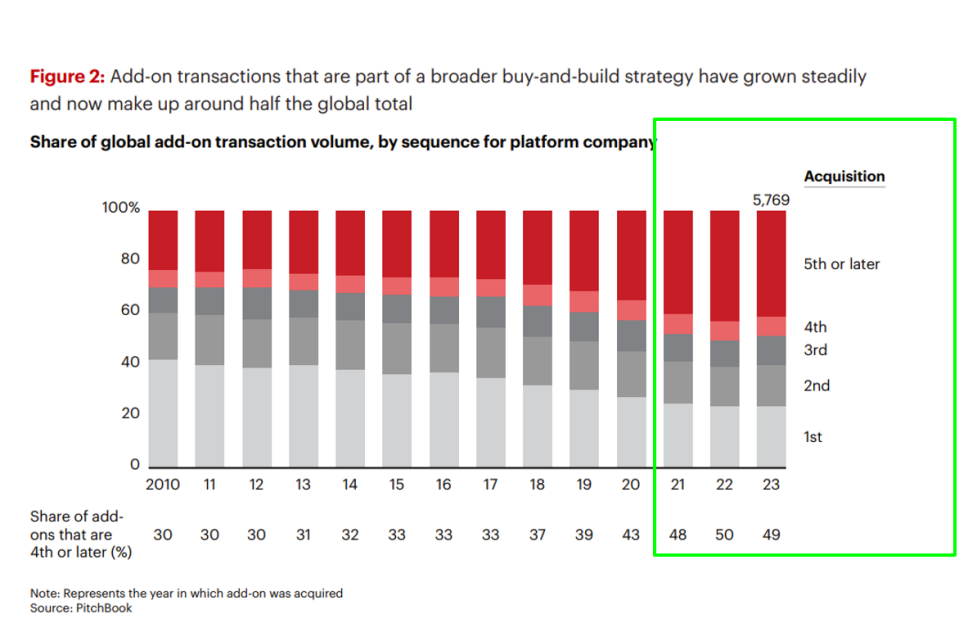

8. Organic Value Creation In Inorganic Ways – Buy and Build

- Buy-and-build continues to be one of private equity’s most popular strategies. The ability to invest in a well-positioned platform company to make at least four repeated add-on acquisitions of smaller companies to capture benefits of scale. The success of this strategy is dependent on how a well-integrated consolidation strategy will:

- Open up new customer segments,

- Add lucrative new geographies or channels,

- Expand the customer offering, or

- Substantially improve operations

- Many platform deals were started in a low-rate environment and aren’t yet completed. For them, generating an acceptable return has gotten a lot harder. GPs are focused on completing these platform deals instead of starting new deals

9. Cash Became King Again

- Future fundraising will depend on the industry’s creativity in returning cash to investors. Buyout GPs have 28,000 unsold PortCos worth a record $3.2 trillion

- Drawdowns from recent post pandemic fund vintages are tracking the 2006 vintage closely – a vintage of buyout funds which struggled with recession driven poor PortCo performance and stretched out holding periods

10. Cash Became King Again – DPI

- GPs need a holistic, portfolio-wide strategy that uses every tool at the firm’s disposal to boost distributed to paid-in capital (DPI)

- Improve EBITDA of PortCos and shore up the exit story

- Some PortCos will need a formal “re-underwriting”

- LPs are sensitive to tactics like funding distributions with NAV loans that generate cash now but obligations later

- Continuation vehicles are evolving and gaining currency, but LPs are often wary of the terms, and, on an industry scale, these vehicles are cash flow neutral

If rates ease up as announced on Wednesday by the Fed, exit conditions can improve as there’s a record $1.2 trillion in buyout dry powder available for sponsor-to-sponsor deals, and a buoyant stock market is propping up corporate buying power.

11. Getting Started with Gen AI – A Priority List for PortCos

- Scanning your portfolio to understand which PortCos might be disrupted, and which may be able to ride that disruption to better performance

- Will Gen AI disrupt a portfolio company’s value chain or economic model?

- Is there a chance to lead the change by leveraging generative AI?

- With short-listed PortCos, link AI initiatives to clear strategic objectives that can boost performance, like customer satisfaction, revenue generation, or cost reduction and have an impact on the bottom line

- Don’t neglect change management. People are nervous about AI

- Clear governance and a detailed execution plan are essential to making change that stick

12. Getting Started with Gen AI – A Priority List for Your Firm

- Bring Gen AI to sourcing and due diligence and think strategically about how Gen AI can drive better returns

- Start building fluency in the generative AI tools that can make you smarter

- Expand the scope of information that the firm brings to bear on investment decisions

- In due diligence, develop scorecard-based protocols to assess generative AI threats and opportunities in every diligence the firm takes on, and is a key component such as legal or commercial diligence

- Use AI tools to speed up and sharpen the underwriting process

- Begin thinking about how Gen AI can transform firm operations

- Streamline or automate back-office functions

- Leverage a firm’s scale by making institutional knowledge instantly available to everyone who needs it

Hope you have found the summary insights valuable. To stay connected with us, subscribe to our newsletter!