From Centralization to Standardization: Next Era of Diligence Intelligence

Join us this July as we redefine what’s possible, one week, one breakthrough, and one global network at a time.

Read MoreProcess Matters – Workflow Technology Empowering People

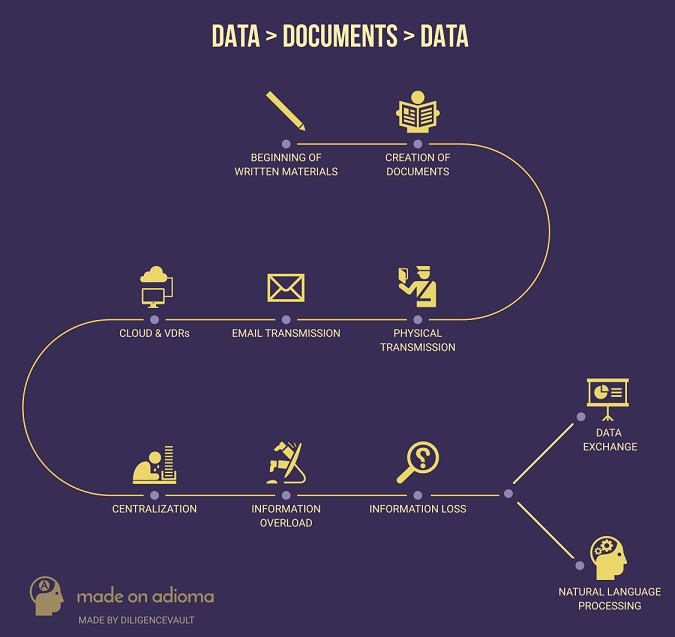

A document is a representation of thought that is written, drawn...

As an entrepreneur at the intersection of Investment Management and Technology, I experienced unconscious gender biases when we started pitching the DiligenceVault platform to users and investors. Our ability to succeed despite these biases inspired...

InvestTech Build vs. Buy - System vs. Product

When we started building our SaaS platform in mid-2014, it was clear that we were going to the cloud. As many of you contemplate hosted offerings, the path we traveled may be of interest for...

Almost one year ago we published our first blog on InvestTech. Over the past year we have seen significant development in this dynamic space. The universe has consolidated as some firms have been acquired, others...

This weekend’s football game of the New England Patriots vs. the Philadelphia Eagles marks the biggest sports-centered holiday in the US, replete with office pools, parties, beverages, foodfests, the cultural karma of the commercials and...

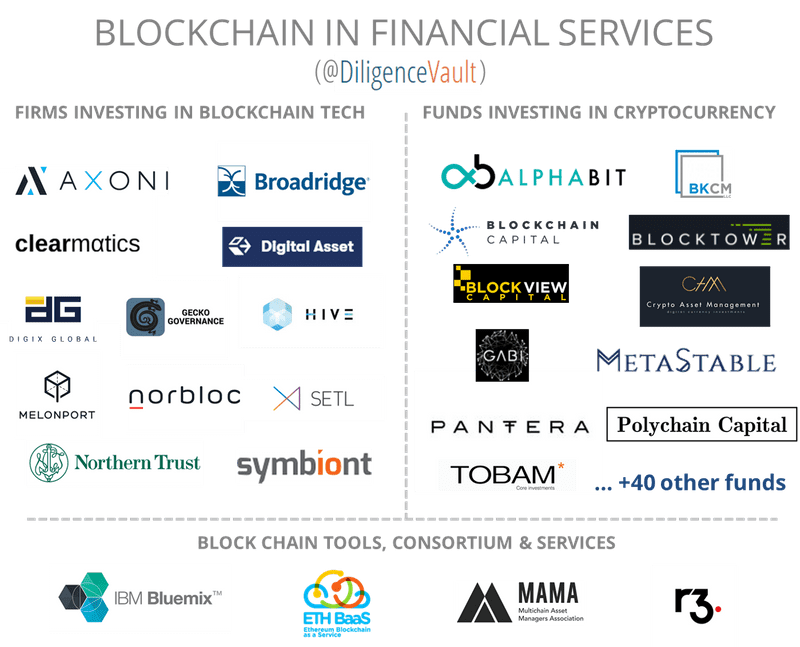

The Questions Du Jour in 2017: Does DiligenceVault employ blockchain technology? Does DiligenceVault offer diligence questionnaire for blockchain investing?