The investment management industry runs on data. Organizations build their businesses around carefully constructed, disciplined processes of collecting and analyzing information that are designed to give them a unique edge in investing. This means that a firm’s decisions around specifically what data to use and how exactly to process it are key. With the mainstreaming of Big Data the largest investment firms are driving the industry forward in centralizing and digitizing the information they work with and being transformed by new data sources.

Analysis of information disseminated in financial statements, sell-side research reports, filings such as 10Q and 10K, and macroeconomic and market data still constitute the fundamental building blocks of successful investing. But the scale and sophistication of available data sets around these sources have increased exponentially, requiring new analytical tools. Apart from the business need, there is the added burden of regulatory oversight, much of which has been tied to documents but is also moving into digitization.

Questions for you, industry practitioner: What information do you need? Where do you source it? And is it in a form that lends itself to optimal efficiency of your process?

Data Disintermediation via Digitization

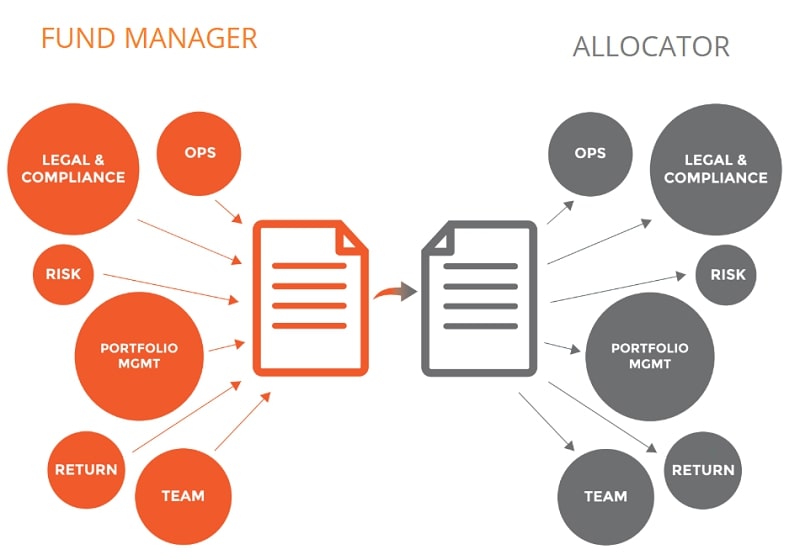

Envision a clear path to your data. What does it look like? It should start with digitization at the source. That is where data can be uploaded, tagged for relevant properties, and normalized at the origin itself. In order to share data, why should it be necessary for someone to create a document or spreadsheet around that data, transmit the file to specific receivers, and then for the receivers to have to extract and transcribe the data in order to use it? Traditional channels of communicating information like documents, spreadsheets, letters, and emails contextualize in order to send a coherent overall message, often serving multiple constituencies, such that the utility for any one consumer is lessened. Like a game of telephone, the intermediaries and suboptimal interfaces can interfere with the underlying content, and certainly the ability to dissect the data.

Technological innovation allows for the mining of existing data in new ways, including extraction of information previously trapped in reports or recordings of calls or meetings. The extraction of information at destination is painstakingly manual. Even when NLP algorithms are leveraged, the accuracy is not 100%. Nonetheless, NLP still turbocharges the scale at which this data can be processed by parsing data out of documents and recordings.

With digitization at both source and destination, the data and its properties are the focus, and there are endless possibilities for where the analysis can lead. Multiple constituencies including investment and operations analysts, compliance, and management can experience faster time to data, at the same time that they benefit from consistency in their information because everyone is leveraging the same data. Digitization disintermediates the process of data analysis at scale.

But wait! A letter to shareholders by a visionary leader can be tremendously inspiring. And close analysis of financial statements can become a fascinating journey of discovery. Yes, gentle reader, there is still very much a need for the traditional content and context created by skilled and talented humans for the human recipients among us 😊. It just needs to be supplemented by digitization, which works better for machine recipients and human-aided analytics at scale.

The Allocator Case for Digitization

Allocator investment processes in general work with some variation on the theme of “5 P’s”: people, philosophy, process, portfolio, and performance. The investment process involves analysis of traditional information sets such as returns, organizational structure, regulatory filings, performance, policies, letters & memoranda. The information is both qualitative and quantitative, and there are huge volumes of it. The choices made around data and tech largely determine the process. For example, does an allocator have tools to first qualify a manager universe of interest across diverse sources including inbound interest and commercial databases, and then screen for funds of interest for further work, across all the 5 P’s? The ability to be active, rather than passive, in determining a universe of coverage and in monitoring existing portfolios could be a key differentiating factor in investing for outperformance. And that ability is driven by technology that provides access to a relevant actionable data set, which is of significant scale and is digitized.

Markets are social constructs, and emotional valence is a key indicator that has been hard to measure until recently. Subtle changes in performance and perception can now be gleaned through social media. As with many other industries, news and social media provide rich new channels of information for investing, but they require new tools to mine this data. Also, new fields of information such as ESG or impact criteria bring with them new data sources in the form of databases and consultants tracking added dimensions of performance. Digitization streamlines the discovery of correlations and enables predictive analytics, allowing allocators to work smarter. The new data sources and technologies are revolutionizing processes and outcomes in investment research, operational due diligence, risk management, and compliance.

Other organizational benefits can include centralization of information relevant to multiple constituencies within the firm, eliminating silos, duplication of efforts and inconsistencies. This allows investments, operations, compliance and consultants to leverage a single source of truth, supporting data integrity and consistency of information.

The Fund Manager Marketing/IR Case for Digitization

Maintaining or even gaining market share in the competitive world of fund managers is a huge challenge as marketing/IR teams vie for the attention of investors barraged with information and those seeking investment. Digitization and centralization can give IR teams the power to be responsive to more investor requests faster. Moreover, digitized information can be repurposed via NLP algorithms; it does not need to be custom tailored for each consumer, which saves tremendous cost and effort.

Digital engagement models can give fund marketing a leg up by understanding investor preferences, thereby enhancing efficiency with more effective dissemination of information. Data is also used to segment markets of interest and track investor client decision cycles. Information gleaned through these engagements can also enhance product development, supporting growth in AUM as firms create new products that meet investor demands. The appropriate information delivered in a user-friendly interface enhances the investor experience, further underscoring the success of the fund manager.

Data, data everywhere, but not in usable form!

Access to actionable data drives business success: the ability to cut costs, grow revenues, strengthen processes, support governance and risk management, improve transparency, enhance business and compliance oversight, and improve reporting capabilities to management, clients and regulators. A long list of potential contributions! The current reality, however, is that data and technology are balkanized, territorially divided by application, market segment or operating division, trapped in hard drives and folders, databases with their own internal logic, emails, faxes, documents and spreadsheets, all requiring multiple transfer points which create loss of efficiency and insights at each stage.

Allowing data and technology to realize their promise requires solving fundamental operational challenges around capturing, storing and analyzing it. Other challenges include searchability, sharing, transferring, visualizing, querying, and updating, while maintaining quality. These issues will resonate with practitioners in the investment management industry, where comprehensive solutions have lagged.

How are firms solving the challenge?

Technologists and data scientists are playing a growing role within the investment management industry as it incorporates the new technologies and data sets. For example, AlternativeData.org found that the number of roles in alternative data at fundamental funds grew from 8 in 2000 to 903 in 2017.

Professionals like these are setting up warehouses of data with ever more ambitious goals involving sophisticated analysis of qualitative information and meta data, as well as quantitative analytics. They are taking charge of their data and sourcing directly to ensure accuracy and utility. They are working on connecting and centralizing information so that it flows freely to all constituents who need access. And they are actively seeking technology solutions that can help them accomplish these objectives. The success of their firms may depend on it.

This holiday season consider giving yourself and your team the gift of data disintermediation in the form of leading-edge investment technology. It will be the gift that keeps on giving!