We Didn’t Do Anything Wrong, But Somehow, We Lost….

Nokia’s smartphone division was recently acquired by Microsoft.. and this is how Nokia’s CEO ended his speech. They did not do anything wrong, but lost as they failed to keep up with the innovation in the industry.

Common themes across firms on why innovation is not center stage.

What’s it worth? Value is not immediately clear. Also what is not clear is if it is a long lasting trend or just a fad

Let’s wait and watch: Humans tend to overestimate the impact of disruption in the short run, and underestimate in the long run. As a result, innovators tend to give up as it is iterative and is not an overnight process, and / or enter the waiting game

You realistically only get one chance: For startups, the idea of failure as a path to success is accepted, and in fact celebrated. However for established firms, there’s zero tolerance for losing from a point of success

This is how we do things: Powerful phrase in indicating a process or a thinking, but at the same time a significant roadblock to innovation

Why now? Focus on immediate business priorities is an undeniable reality

In spite of the above, how to make innovation work?

I recently came across 10 types of innovation by Doblin which categorized innovation into configuration, offering and experience. Just focusing on configuration, and applying our viewpoint to financial services industry, following are the areas of innovation which the industry has benefited from:

- New Market Access: Where the firm builds access in new markets and segments. eg. emerging markets, peer to peer lending

- New Product: Development of new products and offerings for existing clients, similar to ATMs, derivatives, liquid alternatives, cryptocurrency

- New Business Model: Entering the market with a new pricing or new bundled access, eg. fund/manager databases, co-op research models, managed account platforms

- Process Re-engineering: Usually an internal innovation in creating competitive advantages, in areas of underwriting process, investment research, trade reconciliations

While the industry has seen pockets of innovation, it still is behind. One of the strongest trait of financial services industry is that it is complex, fragmented, and process driven and operates on an inefficient technology infrastructure, and has plenty of room for innovation.

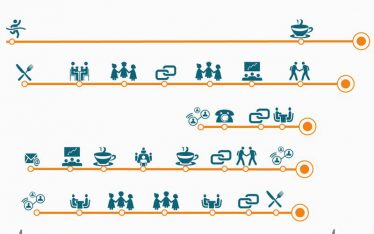

Reflecting on some personal experiences on innovative firms (log normalizing the firm sizes in the below chart, so we can show up on the same chart as a global bank :)):

Enterprise: I have been part of a global financial services organization > 250K employees. Over the years, the firm introduced a corporate venture arm. This is the same firm that invented ATM, and then grew by acquisitions, was a leader in numerous product innovations, but lost steam in market innovation, as well as internal process re-engineering.

Startup: In contrast to the above, now I am founder of data and tech startup for the investment management industry, where production innovation comes easy as we combine technology with our industry expertise, and successfully developing market footprint remains next challenge.

Client partnership: Early adopters of our platform who are believers in our value proposition and validate our business model. These firms are willing to take a chance, and build safeguards to limit their exposure to failure, but at the same time taking the long view.

Accelerator: Participating in an asset manager backed accelerator that is getting behind innovation, where the focus is to partner with data and technology startups who are influencing the industry.

Drawing up on the variety of exposures to innovation, below are some of the realities of innovation:

Innovation doesn’t always have to be the next cool thing. and it does not always need technology. I would argue that re-thinking of entrenched processes, automation of key bottle necks, easy access to information, data visualization, client engagement, strengthening of existing offering all classify as innovation, but are not often now viewed as one.

Innovation is not synonymous with disruption. We are often asked – are you looking to disrupt the industry? Whom are you disintermediating? The answer is almost always no one. In the day of robotization and technology for everything, we are empowering the industry participants to be iron men and women.

It’s easier to invest in innovation than it is to adopt. For example, a good % of backing for cloud infrastructure firms is received from financial services sector including asset management firms. But these same firms are hesitant in embracing cloud technologies and need time to adjust to the changing landscape.

Innovation is almost always personal. Organizations innovate when they have leaders who innovate, someone who develops a culture of taking chances, observing and experimenting, and someone who accepts the possibility of failure.

Lastly, innovation doesn’t have to happen in isolation. It could happen in partnership with a client or strategic partner or can be industry-wide if dominant players collaborate.

Innovation strategy for the financial services industry

In the race to innovate, technological innovation is a low hanging fruit for our industry. When combined with process, product and market access, it could be transformational for the industry.

Often times, you can do nothing wrong, and lose, or you can be right and not be guaranteed success. Internal or industry wide, product or market, innovation requires a dedicated strategy and culture, and rarely works if adhoc.