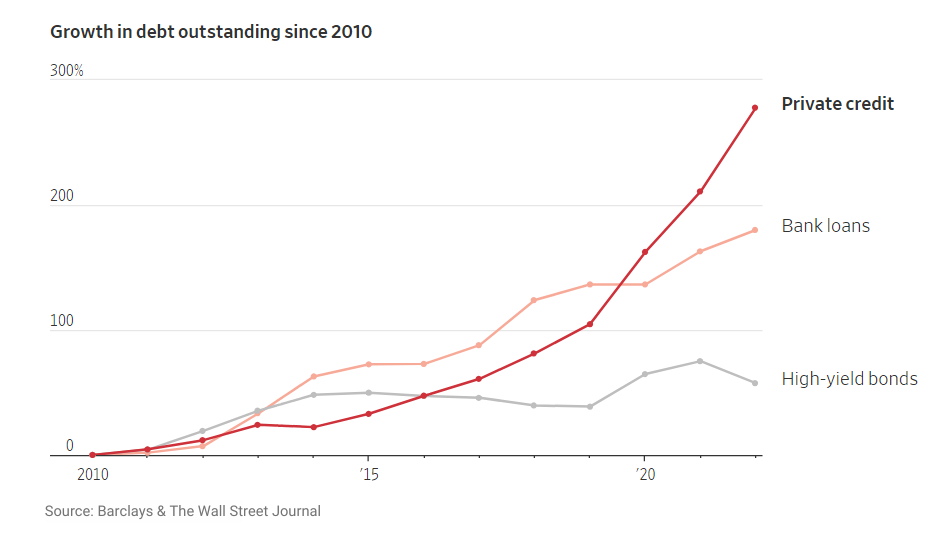

Private credit or private debt investment strategies are being viewed as attractive investments in the current environment for its expected return and volatility profile.

Given the increased appetite, we share a SIX point due diligence framework for investors considering these fund structures:

ONE: Fund Structure & Strategy

Due diligence focus is to understand the fund focus, portfolio construction, and structural leverage. Questions to explore include:

- Which part of the capital structure is the fund manager focusing on? Is it a high risk or capital preservation mandate?

- Will the fund be using leverage?

- What is the interest rate sensitivity of the mandate? Is it fixed rate or floating rate exposure?

- How is the fund manager sourcing the opportunities? Is the sourcing process differentiated? Is it data-driven? Is it scalable?

- What market capitalization is the fund focused on?

- What is the underlying asset – is it a corporate, real estate, or specialist asset class including fund finance, supply-chain finance, litigation finance, sports finance, and aviation finance?

- What is the diversification profile? Is it a highly concentrated portfolio or is it a diversified mandate?

- What is their investment pacing?

TWO: Track Record Evaluation

Due diligence focus is to understand the fund manager skill and understanding drivers of performance and include:

- With the increase in demand for private credit investments, we have seen many new launches and first time funds. With limited track record for some of the new launches, evaluation of the portfolio managers prior credit underwriting experience becomes important.

- At the same time, if the track record is for a market cycle which had benign credit conditions, it could also provide a false sense of security. It’s important to evaluate track record across a full credit cycle

THREE: Underwriting Framework

With loss avoidance as a key factor for returns in credit investments, underwriting standards and models play a significant role:

- What credit underwriting process is the fund deploying and have they been disciplined? How has the underwriting standard shifted in the last 24 months? The impact of more capital in this space may result in pressure on the quality of underwriting

- What underwriting terms are being used? Are payment terms cash of PIK, what covenants are being used? What is the maturity structure? And what types of LTV (loan to value) collateral safety is available?

- What factors are included in the loan documentation around collateral rights, credit subordination, or any conflicting rights?

FOUR: Portfolio Monitoring

Post-investment portfolio monitoring is a key factor which has a significant influence on the return profile, especially for longer dated underwriting.

- How does the fund manager monitor KPIs around covenants? How often do they collect and report on that dataset? What portfolio monitoring and transparency framework is in place

- With access to real-time or near-real-time data, fund managers can adapt quickly to changing market conditions. This agility is crucial in adjusting underwriting strategies, identifying emerging risks, and capitalizing on new investment opportunities as market dynamics evolve.

- Given the macro risk factors, does the fund manager have experience in remediation or workout? What is their impairment process? Most banks with corporate lending teams also have specialized workout teams which take front seat when the credit deteriorates to minimize any principal loss for the bank.

FIVE: Operational Due Diligence

In addition to the main ODD focus, the assessment of the fund’s operations is also an area where risks can loom large.

- The volume and complexity of private credit portfolios can be high, resulting in elevated risk of operational risk. There is limited standardization in private credit metrics and KPIs tracking as the deal structure can be quite different with many different variables.

- Cash movements and allocations are key areas to evaluate from an operational perspective

- Further, having service provider partners who understand the private credit accounting and management is also crucial aspect of the due diligence

SIX: ESG Integration

Last but not the least, ESG integration is an important element to evaluate in private credit and corporate lending. Assessing a fund’s approach to ESG principles adds an extra layer of understanding its long-term sustainability and societal impact.

Additionally, industry organizations like AIMA, LSTA, and PRI have valuable resources that investors can reference as they are creating, reviewing or updating their private credit due diligence framework.