Per Mckinsey’s private markets 2022 report, fundraising was up by nearly 20 percent year over year to reach a record of almost $1.2 trillion. However, the rise of inflationary pressures, growth slowdowns, and end of business cycle concerns are clouding the path forward.

In the current environment, how should LPs recalibrate their due diligence process? It’s important to evaluate available information, and explore new datasets to help drive informed decisions.

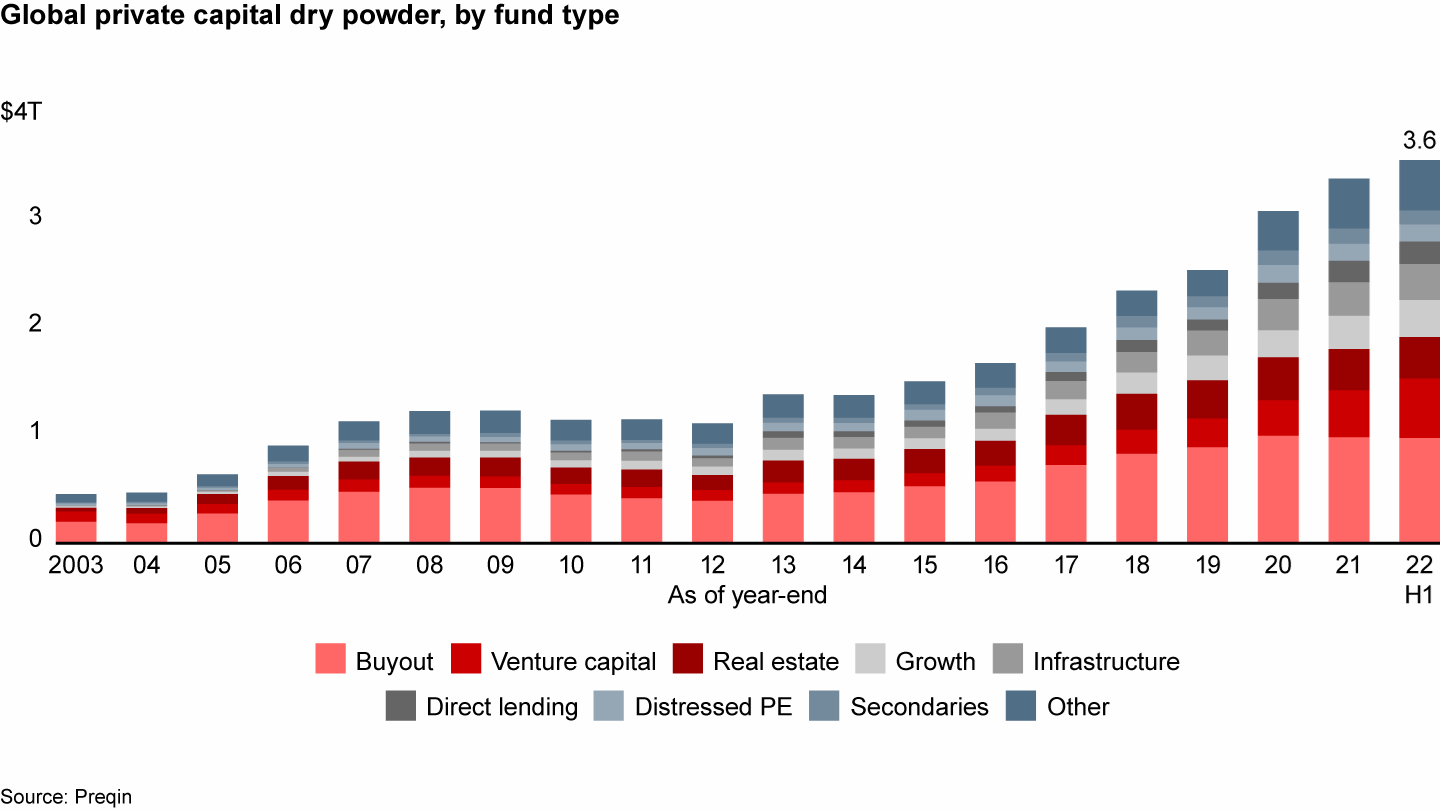

1. Per Preqin, GPs are sitting on a lot of drypower, which continue to earn fees, and in turn reduces the business stability risk in general for GPs in such cohorts.

2. GPs with dry powder are well positioned to take advantage of better valuations when investing in high quality portfolio companies. This bodes well for current vintage funds and future return expectations.

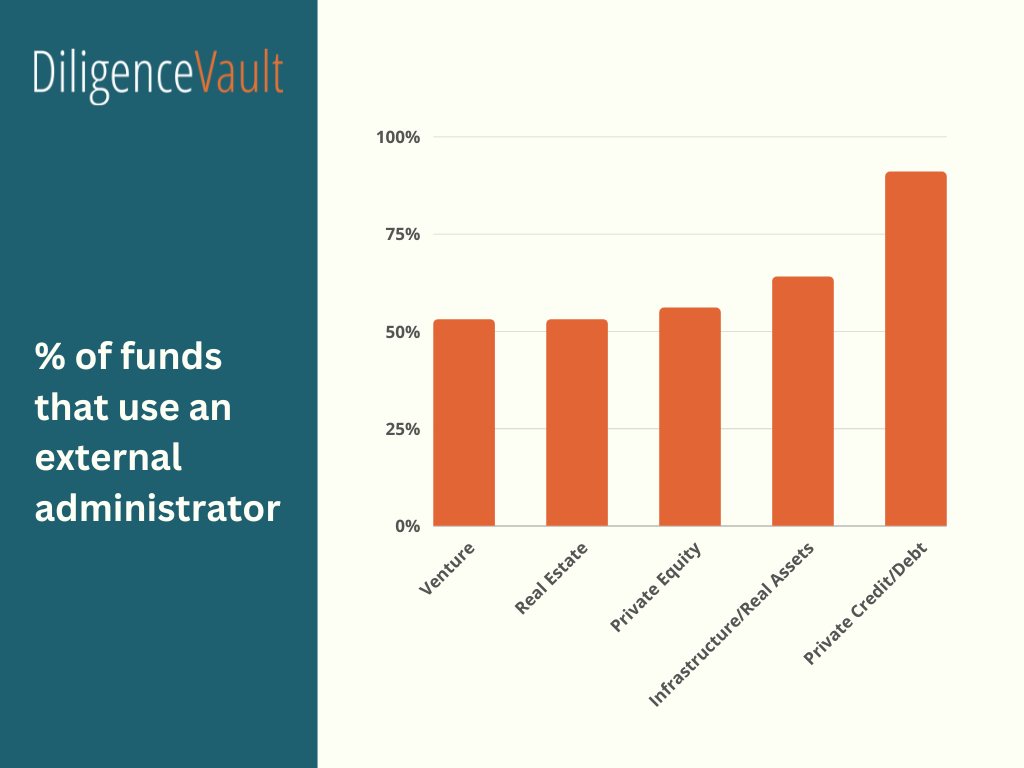

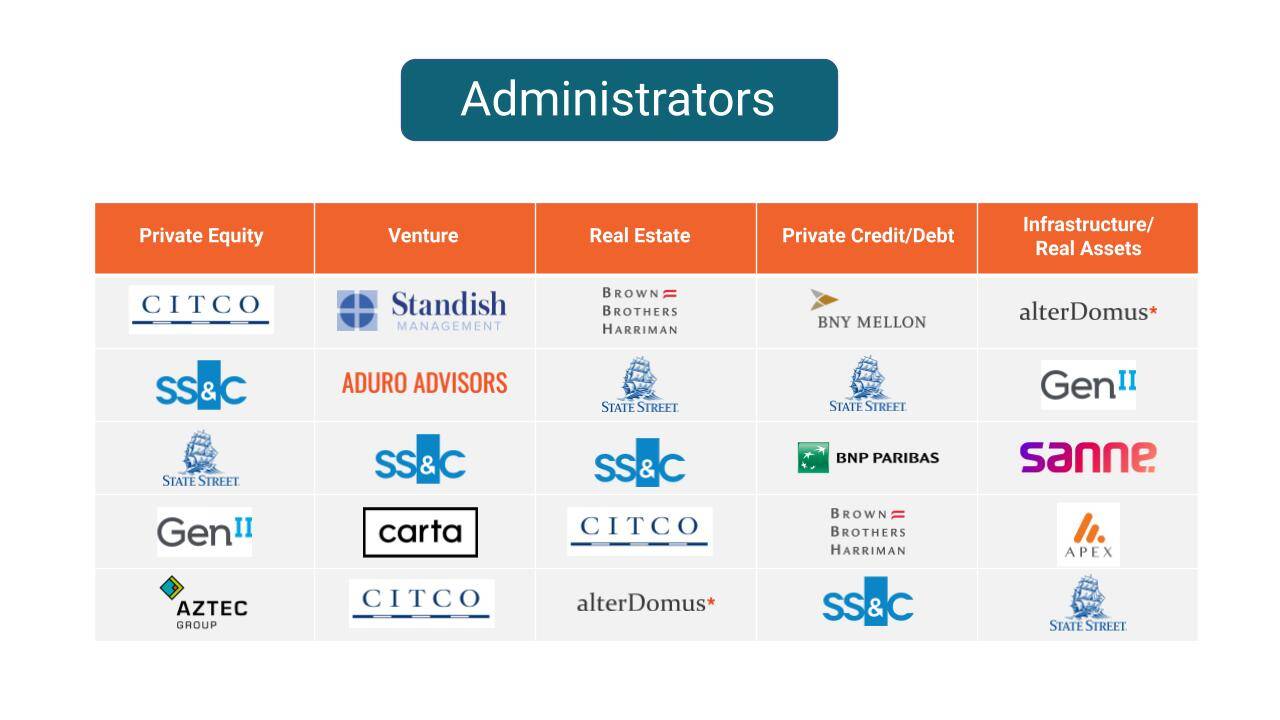

3. As exits slow down, valuations become ambiguous in uncertain times. It’s important to ensure GPs have the right valuation controls, and an objective valuation process with an independent oversight process. GPs that self administrator or work with unknown administrators will attract greater scrutiny given the elevated risk.

4. As the private capital industry expands and fund managers increase their AUM, scalability becomes a significant issue. While use of an administrator is fairly consistent across most private markets strategies (between 53%-64% for PE, RE, Infrastructure) a vast majority of private credit managers use an external admin according to our survey. Private credit managers were also the most likely to use an outside valuation service to mark their books. Conversely, only 10% of venture funds use an outside valuation service.

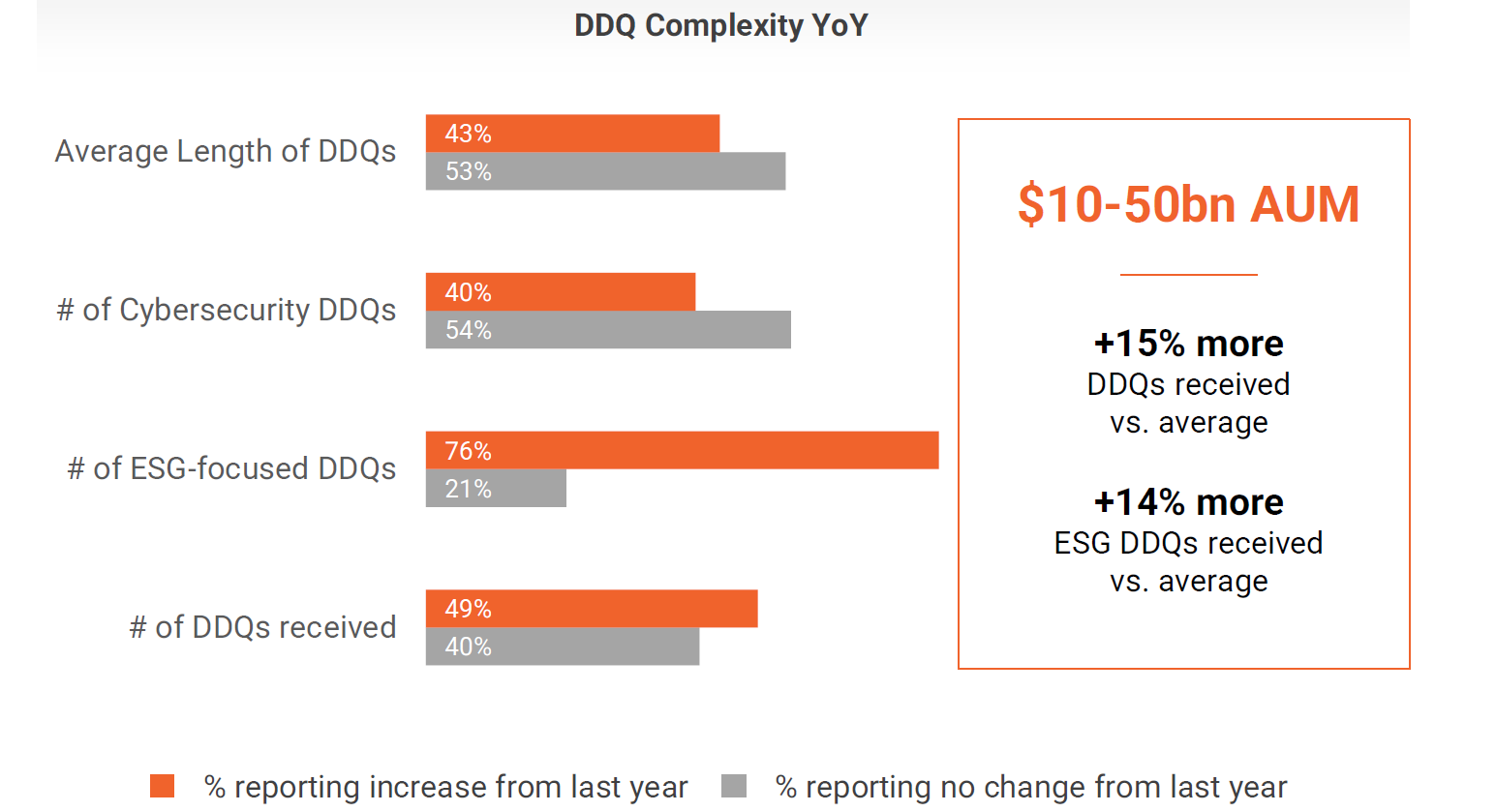

5. Investor transparency needs go up. According to a recent poll, “coping with more investor requests/reporting” was the number one cited challenge by PE CFOs.3 The external fund administrators who provide a number of back and middle office functions for private fund managers can also help with fund accounting and LP reporting. As per our own research survey of over 600 asset managers, we see a significant increase in the complexity of investor requests YoY.

6. The alignment of interest between the GP and LP is key in uncertain macroeconomic environments. One of the most frequent and closely examined aspects of due diligence is understanding the alignment of interests between the GP and LP, with the managers’ capital invested in the fund as a key metric to evaluate for allocators. Private equity and Infrastructure managers had the most “skin in the game” with both groups of funds having at least 17% of AUM coming from the GP. Private credit managers, however, had 55% of funds with no allocation from the management company.

7. Timely updates to LPs is critical, as it is important to see if the GP is consistent in providing accurate LP reporting and appropriate regulatory filings. In the private capital GP ecosystem, 2-4% firms are delayed in filing with the SEC, with Private Equity strategy having the poorest record. SEC Charges Two Advisory Firms for Custody Rule Violations, One for Form ADV Violations, and Six for Both.

8. Reviewing GPs disclosure reporting remains a prudent risk management tool. Form ADV Part 1A, Item 11 requires registered GPs to provide a response to numerous disciplinary questions. The questions can be broken down into three categories: Criminal Action, Regulatory Action and Civil Judicial Action. If a manager answers yes to any of the questions, they must fill out a Disclosure Reporting Page (“DRP”) to provide more information. From utilizing the DiligenceVault Form ADV module, we see that Real Estate managers had the greatest number of violations with 33% of all managers reporting at least one of the aforementioned violation types. Conversely, only 11% of venture capital managers reported any kind of violation, which could partly be explained by low complexity environments if small firms as well as VC’s apply for ERA status.

Now that we have examined this topic from the lens of LP due diligence, let’s see what GPs who are fundraising can implement in this opportunistic market environment.

Fundraising in 2022-2023

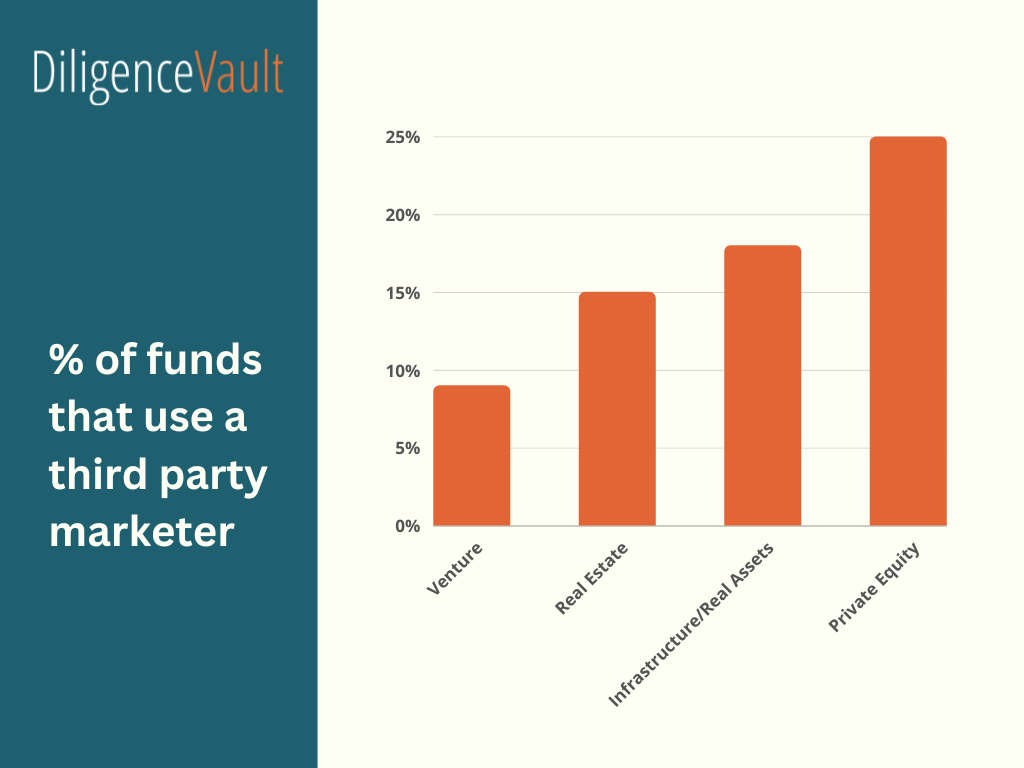

1. GP’s looking to fundraise in this environment can benefit from the use of placement agents. Our analysis of Form ADV data shows to no surprise that private equity funds are the most likely to use a third-party marketer given their greater number of assets and being more geographically diverse.

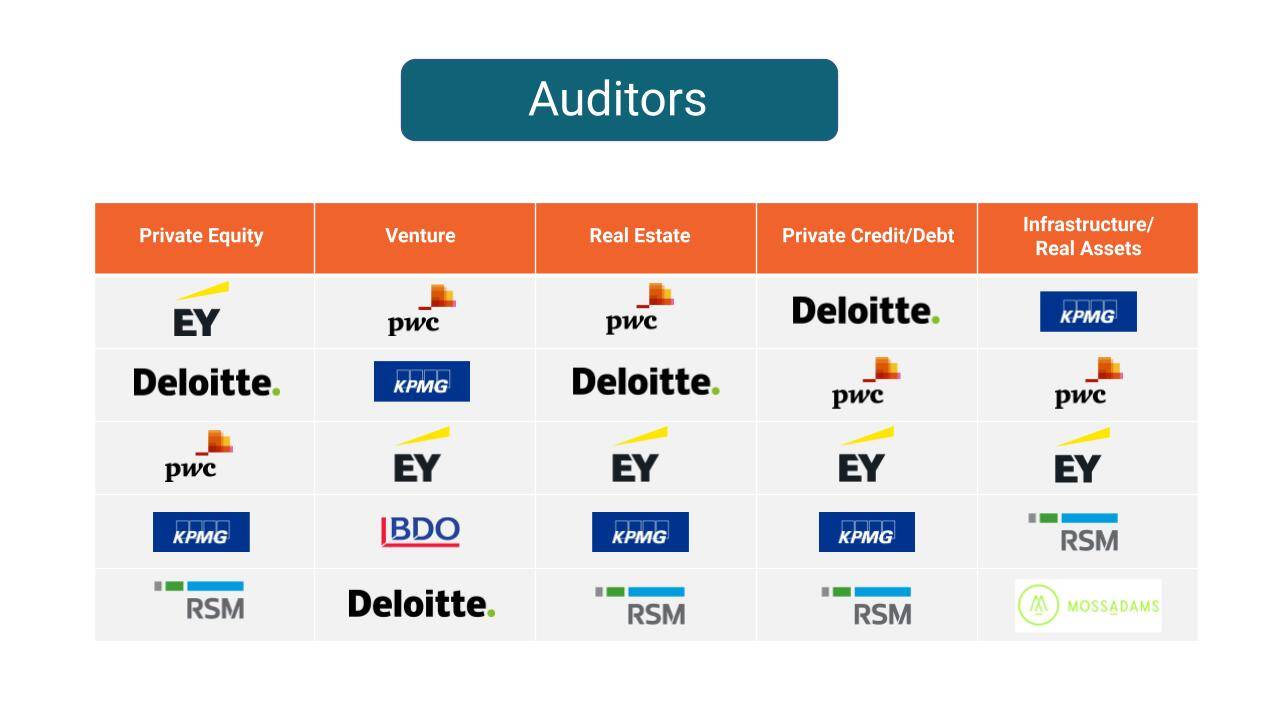

2. Use of service providers: When returns are under pressure, there’s greater scrutiny on business risks. Ultimately, what GPs need to keep in mind is that any use of service providers – who they are, what their function is, what does it cost, what are their controls – will be closely analyzed by prospective LPs as part of their operational due diligence (ODD) review.

The decision to outsource or keep in house any particular function across the firm will of course, be driven by any number of internal and external factors, including fund size and investment strategy. (For a more in-depth look at how private equity fund managers utilize outside service providers, see Appendix A in this report).

Service Provider League Tables:

3. Minimum Investment amount: As capital continues to be allocated to alternative investment strategies and funds subsequently grow in AUM, GPs are looking to better manage the number of investors in their funds. Almost a third of private equity and real estate funds now require at least a $10 mil investment in a fund. Conversely, a majority of venture funds, which have smaller fund sizes, will still accept a minimum investment of $1 mil or lower.

Conclusion

Benchmarking your GP portfolio or your own firm to the peer group and the industry overall has always been a good due diligence practice, but in this environment, benchmarking operational risk factors becomes even more crucial.

Also, given the long tail of GPs in private markets, with a wide dispersion in performance, LPs have a more complicated job to do as more and more private markets managers move beyond small operations into more complex institutional-quality investment organizations.

Take advantage of the one pager based on the SEC’s FormADV data of each private markets strategy to benchmark your GPs, and also drill down to view asset base, region, and team size stratification for a more meaningful analysis leveraging the ADV datasets.

DiligenceVault Private Markets ADV Data Overview – https://diligencevault.com/private-markets-adv-data-overview/