A robust due diligence and investment oversight program relies on well-defined risk assessments or portfolio scorecards. These assessments form the bedrock of a consistent and defensible diligence and oversight strategy, ensuring that your portfolio meets its risk and return targets.

In our experience working across various jurisdictions and fiduciary clients, we’ve seen teams across different functions use portfolio scorecards and risk assessments to great effect:

- Investment and manager research teams utilize them to track high-conviction investment opportunities

- Operational Due Diligence (ODD) and compliance teams rely on them to maintain oversight of key risks

- Enterprise risk teams use them to aggregate risks across multiple stakeholders

- Delegate oversight teams, especially those involved in outsourcing and ManCo oversight, find them indispensable

- ESG and responsible investment teams leverage them to monitor engagement and progress

- Audit teams use them to track audit findings and remediations

These assessments generally fall into two key categories among the firms that use them: those that highlight return opportunities and those that help document, monitor, and escalate risks.

Benefits of Risk Assessments and Portfolio Scorecards

The benefits of these assessments include:

- Flexibility: The ability to focus on current risks and opportunities while incorporating emerging risks and opportunities

- Enterprise View: Breaking down silos by standardizing and controlling frameworks across the firm

- Visual Representation: Assessment heatmaps provide a visual representation of risks and opportunities, making it easier to identify and understand the relative significance of different factors

- Data-Driven: By drawing out a factor score, the assessments make the sourcing and investing process more data-driven

- Time Series: A consistent assessment over time strengthens resilience and provides the ability to assess trends

- Decision Making: By ensuring a scalable framework that considers judgment, external factors, macro events, and related factors, assessments deliver consistency and objectivity in decision-making

- Efficiency: One key benefit of assessment is that it documents the team’s framework, enabling faster learning cycles for teams

- Resource Allocation: They assist in allocating resources or capital more effectively by directing them towards areas with the highest risk exposure or opportunity set

In building robust assessments, clients leverage various intelligence and automation functionalities, such as DiligenceVault’s sophisticated ratings, scoring, and flagging functionalities.

Five Use Cases of a Portfolio Scorecard / Risk Assessment:

- Maintain a Tracking Scorecard: Firms can track over 25 factors across each asset they invest in to maintain the progression of these factors and ranking across all factors.

- Institute a Pass/Fail Governance: Firms can use a consistent way to document and tally the strengths and weaknesses of assets, creating a pass/fail decision. This multi-factor framework builds objectivity, transparency, and peer bench marking.

- Incorporate Risk-Based Reviews: Firms can maintain a risk assessment that re-calibrates risks for each asset, helping drive a framework of reviews. High-risk assets need greater oversight, and the risk assessment can identify these areas.

- Create a Best Practice Benchmark: Assessments can identify leaders, middle-of-the-pack, and followers in areas like governance, underwriting, and valuation practices. Developing these benchmarks and identifying transitions in them are valuable tools for future decisions.

- Build an Escalation Matrix: Marrying flags and scores can help create an escalation matrix, identifying assets with the highest flags or changes in the number of flags with no remediation. Documenting this helps create an escalation matrix for collaboration with subject matter experts and senior management.

What are the Best Practices for Creating and Maintaining Assessments?

While there are many benefits to risk assessments and portfolio scorecards, the implementation of such frameworks requires the right methodology for the function, underlying strategy and the firm’s fiduciary goals.

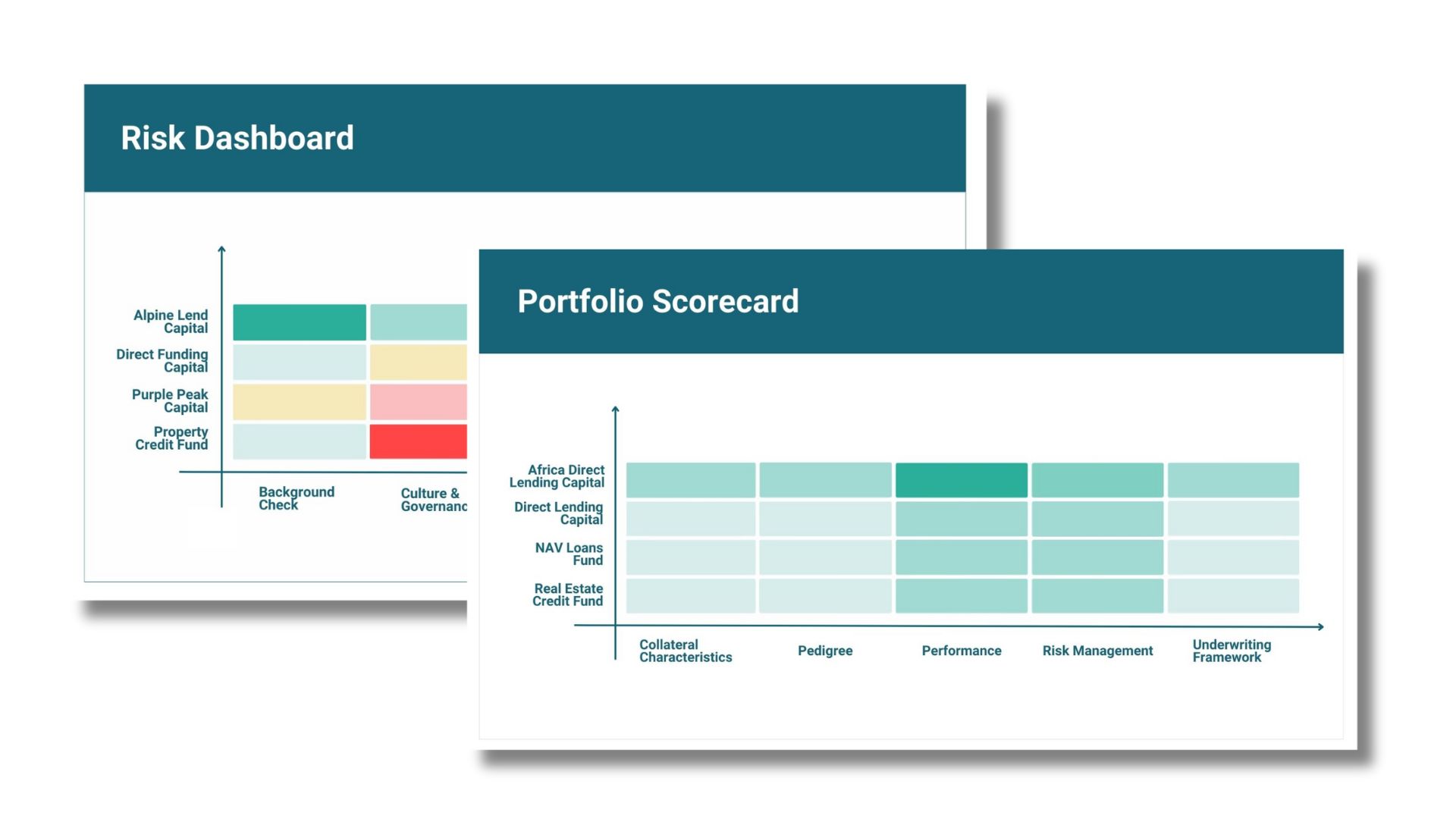

Example of a 5-factor Portfolio Scorecard and a 10-factor Risk Assessment:

Private Credit Portfolio Scorecard

Investment teams rely on portfolio scorecards to source and underwrite new investments. Having a consistent framework speeds up decision making, builds a database of factors that help in creating a long term and sustainable differentiating factor.

Below we share an illustration to evaluate underwriting framework, collateral characteristics, performance expectations, risk management and the pedigree of the team.

ODD Risk Assessment:

ODD Risk Assessment:

ODD, compliance and risk teams rely on risk assessments to identify gaps and weaknesses, collaborate with the investment manager on potential remediation, and benchmark factors against best practices. Below illustration shows five factors, but can also extend to over 50 factors and sub factors. Risk assessments often adopt a traffic light to highlight risks and trends in risk factors.

Data-Rich Scorecards for Informed Decision-Making

Data-Rich Scorecards for Informed Decision-Making