DiligenceVault’s AFS Analysis Module redefines how investment teams approach the Audited Financial Statements Review. With AI automation, built-in risk detection, and seamless collaboration, your team can gain deeper insights faster.

Essential GenAI and LLM terms for due diligence, investor relations, and asset management teams. Download the free guide from DiligenceVault.

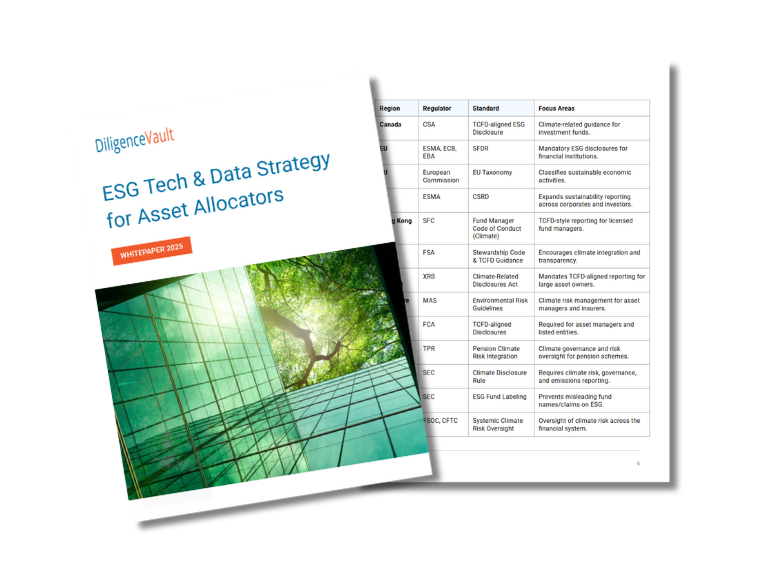

A sustainable investing team's strategic intent is made successful by ESG data that is accurate, usable, and is embedded across the investment process. This whitepaper shows asset allocators how to...

Explore the insights from the 2025 GAIM Ops Cayman Conference, focused on ODD, AI adoption, compliance risks, and vendor oversight in the alternative investment space.

Explore top insights from the 2025 ICI Investment Management Conference, focusing on SEC priorities, fund governance, AI, DEI, Governance and more.

The asset management industry faces massive inefficiencies due to a lack of standardization across reporting, due diligence, and data management. In this blog, we break down the billion dollar problem...

Read the key takeaways from our webinar on when generative AI meets documents: unlocking the magic of intelligence, efficiency, and due diligence at scale

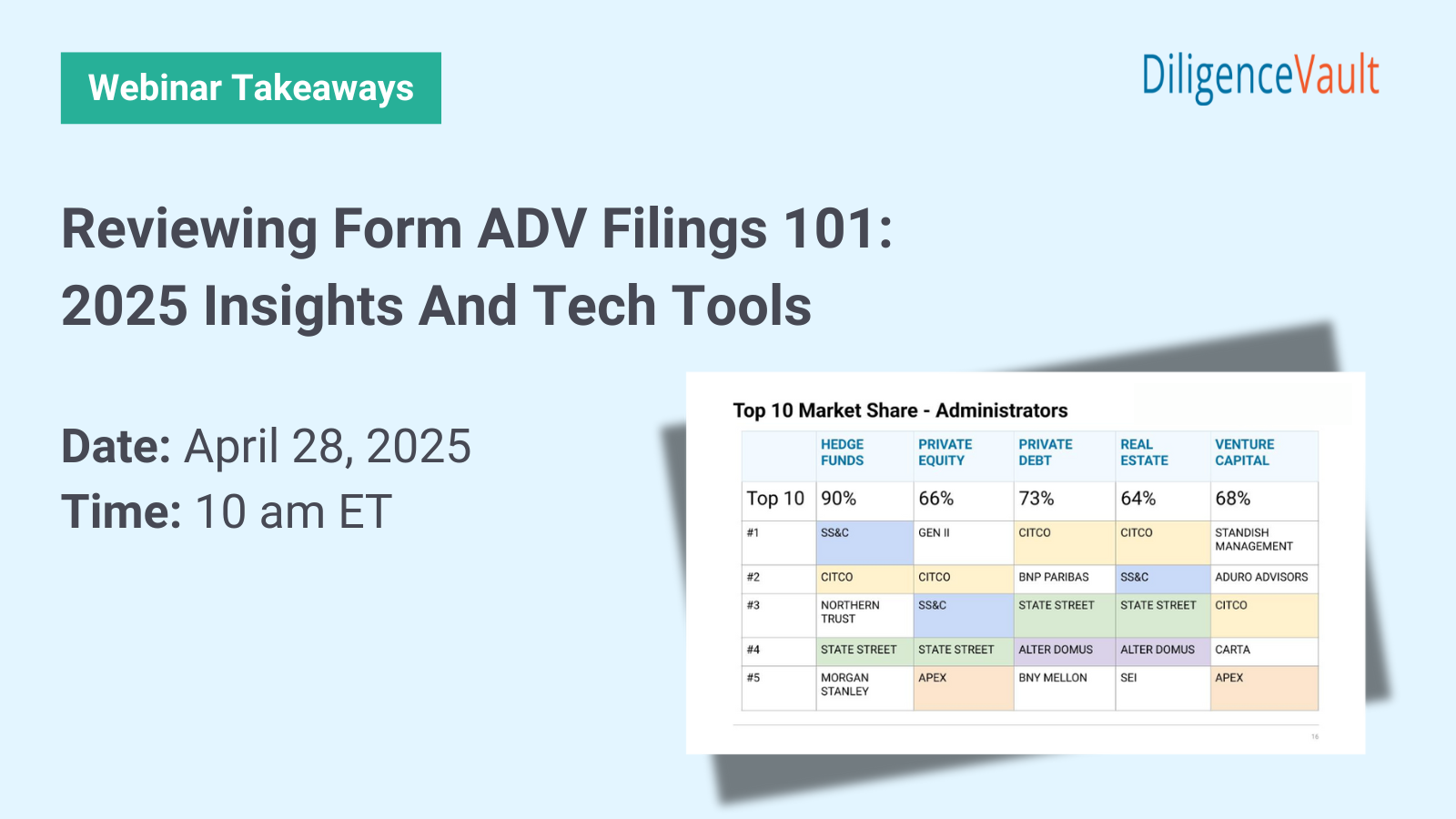

Read the key takeaways from our webinar on Reviewing Form ADV Filings 101: 2025 Insights and Tech Tools.

Learn how prompt engineering can make your due diligence responses more efficient and effective. Register today!

Join us for a webinar on how to leverage prompt engineering for more effective and efficient due diligence response processes. Register today!