A sustainable investing team's strategic intent is made successful by ESG data that is accurate, usable, and is embedded across the investment process. This whitepaper shows asset allocators how to...

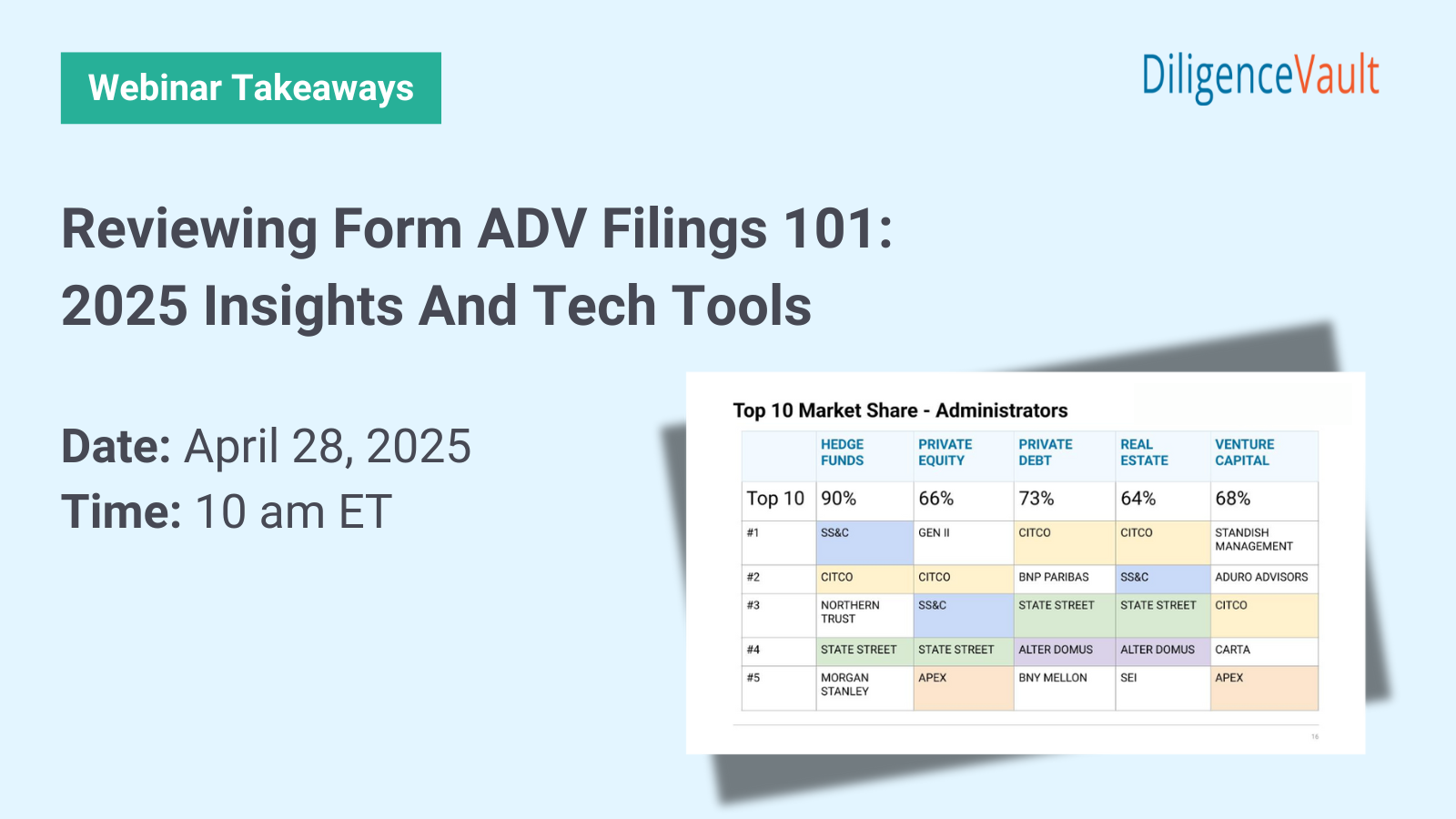

Read the key takeaways from our webinar on Reviewing Form ADV Filings 101: 2025 Insights and Tech Tools.

Learn how prompt engineering can make your due diligence responses more efficient and effective. Register today!

The landscape of sustainable investing in 2023 has evolved from a realm of aspiration and confusion to one marked by maturity and clarity. In this whitepaper, we highlight three building...

How are the US, UK, Australian, and Dutch pension allocators making private equity investments in response to markets, industry structural changes, and reforms?

As DiligenceVault continues to support industry standards in digital format for our users, we are thrilled to add the eFront ESG Outreach framework onto the DiligenceVault platform.

The Impact and ESG investing space is growing and changing rapidly. These are a few of the emerging trends that we are paying close attention to at Veris Wealth Partners.

ESG due diligence is key to understanding the risks and rewards of impact investing, especially with a lack of industry standards for measuring ESG investment risk.

ESG due diligence is key to understanding the risks and rewards of impact investing, especially with a lack of industry standards for measuring ESG investment risk.

Demand for ESG investing is exploding across the investment spectrum, giving rise to a number of sustainability working groups in many industries. We’ve rounded them up here.