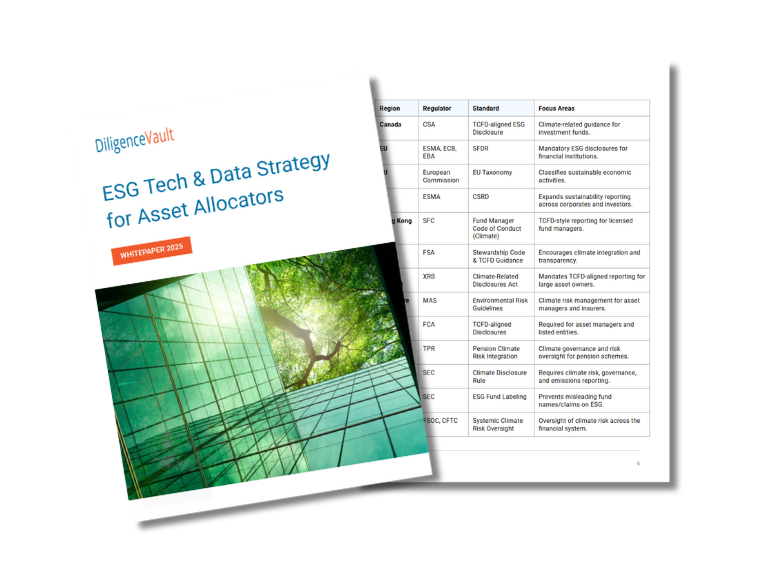

A sustainable investing team's strategic intent is made successful by ESG data that is accurate, usable, and is embedded across the investment process. This whitepaper shows asset allocators how to...

Read the takeaways and insights from our team who recently attended the GAIM Ops West 2024 in Carlsbad, CA.

In this blog, discover how to elevate your experience using DiligenceVault's data integration strategy.

Create a dependable, centralized RFP/DDQ knowledge hub for asset managers to seamlessly repurpose content across diverse reporting needs, spanning both Word and Excel platforms.

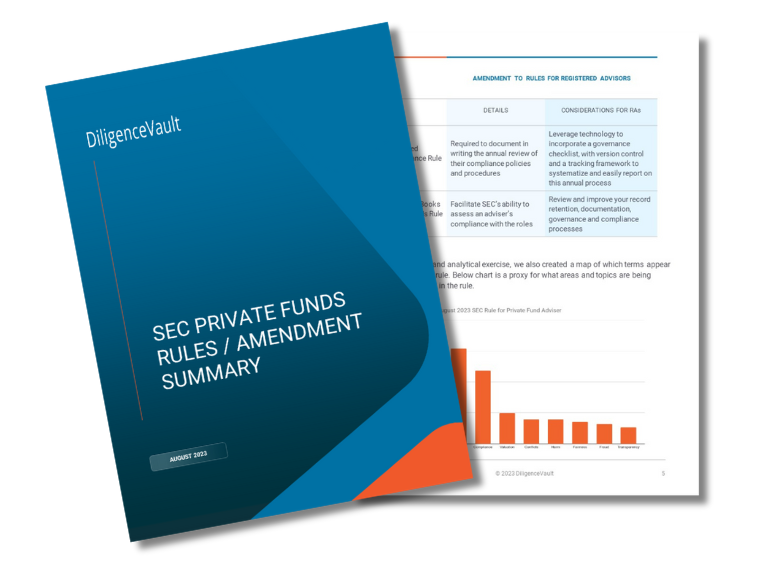

Discover how SEC enhances their regulation of private funds advisors with a set of new and amended rules. - What does it mean for DV clients?

Are you ready to manage the new risk dimensions and complexity, and scale your diligence framework? Learn more about how DiligenceVault Navigating Asset Management M&A: Due Diligence Considerations and Trends

How are the US, UK, Australian, and Dutch pension allocators making private equity investments in response to markets, industry structural changes, and reforms?

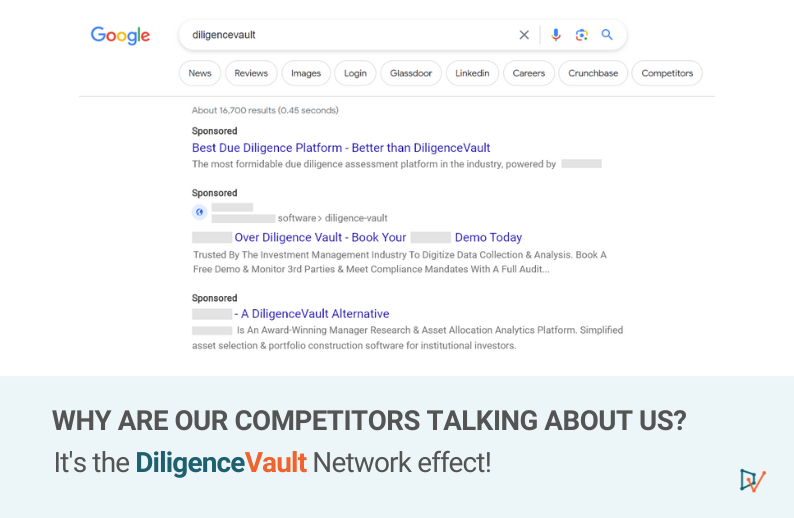

Wondering who DiligenceVault’s competitors are? Learn about how they're validating DV's market position and value through their marketing strategy.

This whitepaper explore the maturity of the various Operational Due Diligence programs, the various data sources leveraged by ODD teams, and how they are integrating their judgement and expertise with...

We are grateful and privileged to experience the milestones and learnings from this chaotic year 2022! Take a peak at our journey!