This whitepaper explore the maturity of the various Operational Due Diligence programs, the various data sources leveraged by ODD teams, and how they are integrating their judgement and expertise with...

The DDQs, RFPs and investor requests volumes have been significantly increasing. In our latest Whitepaper “How to Select the Right Technology to Support Your Investor Relations Teams”, we present five...

Our recent article in AsianInvestor, Leveraging Technology to Power Alternatives Manager Research, discusses the importance of manager due diligence when...

Our expert panelists from Anglo-Swiss Advisors, Capital Generation Partners, Xponance Inc and Conceptual Fund Managers, discusses Active Management & Fund Selection, and more.

Our expert panelists from Citi Private Bank, Goldman Sachs and Pension Protection Fund, discusses private markets diligence, trends, virtual diligence, valuation concerns, and more.

Our expert panelists from Willis Towers Watson, Mercer and Alpha FMC, discusses the global diligence views, trends and learnings around due diligence and technology innovation.

Our expert panelists from a Private Family Office and Cambridge Associates discusses how to set up a data science team, role of data science and technology take in asset allocation,...

Our expert panelists from Wespath Institutional Investments, PKA, and Aksia, discusses the trends, views and learnings around Sustainable Investing.

Our expert panelists from NEPC, TMRS and Texas Tech, discusses about focusing on teams in quarantine, new vs. existing investments, asset allocation, liquidity needs, and new trends in fundraising in...

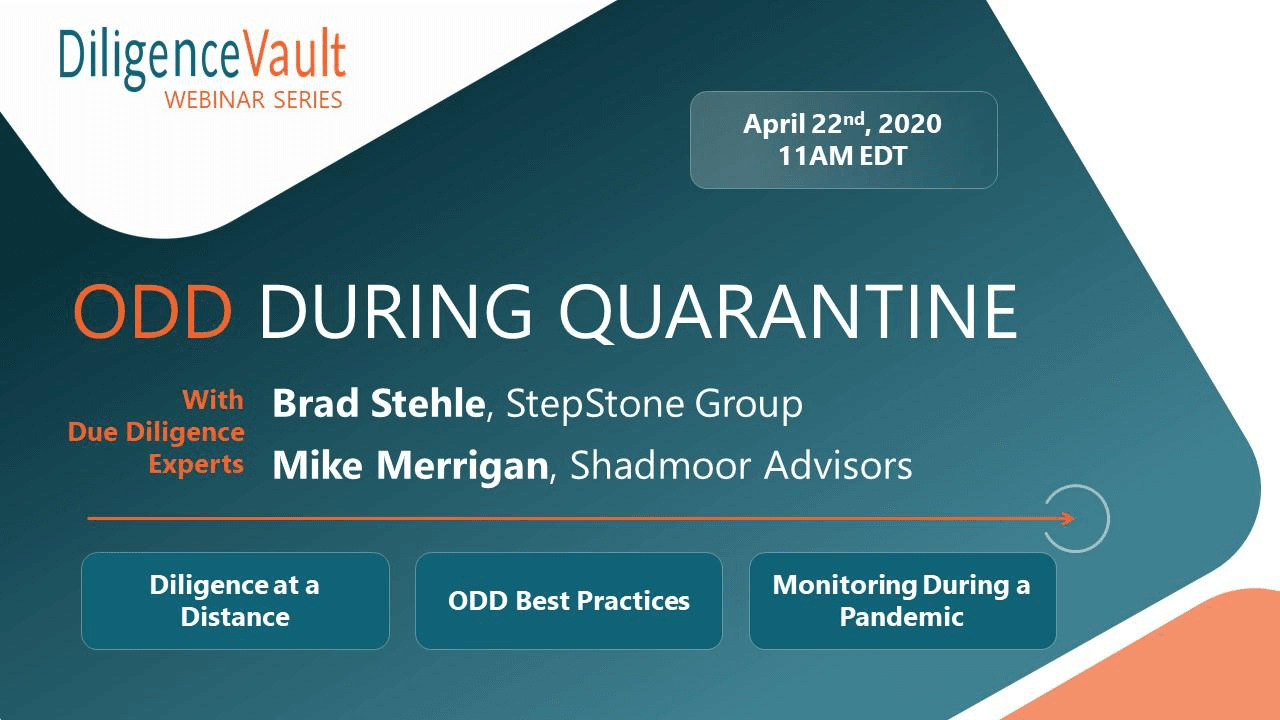

Our expert panelists, Brad Stehle from Stepstone and Mike Merrigan from Shadmoor Advisors, discusses the trends and shared views and learnings around Virtual ODD with over 200 participants.