Artificial Intelligence as a locus of investment is very tempting for asset owners. Expectations for AI are lofty, ranging from cost savings, creating productive capacity, and enabling human cognitive capabilities, resulting meaningful impact on portfolio returns. We did an analysis of popular Google Search terms including AI as a key word along with standard fund investment options, and as seen below, AI was dramatically more popular.

How should asset owners position AI in their investment allocation so as not to miss out on the next transformational investment thesis?

- Allocate passive exposure via investments in a portfolio of tech firms heavily investing in AI. This allocation will capture the point of creation, the firms researching AI. Here is a list of AI ETFs that can accomplish this objective.

- Invest in active mutual funds where portfolio managers are focused on identifying the leaders and winners in this space.

- Partner with Venture Capitalists who are leaders in investing in AI, in both manufacturing and consumer companies, as well as single company SPVs created by leading OCIOs.

- Invest in Asset Managers applying AI as a tool to drive superior investment and operational outcomes.

From AI (Alternative Investments) to AI (Artificial Intelligence)

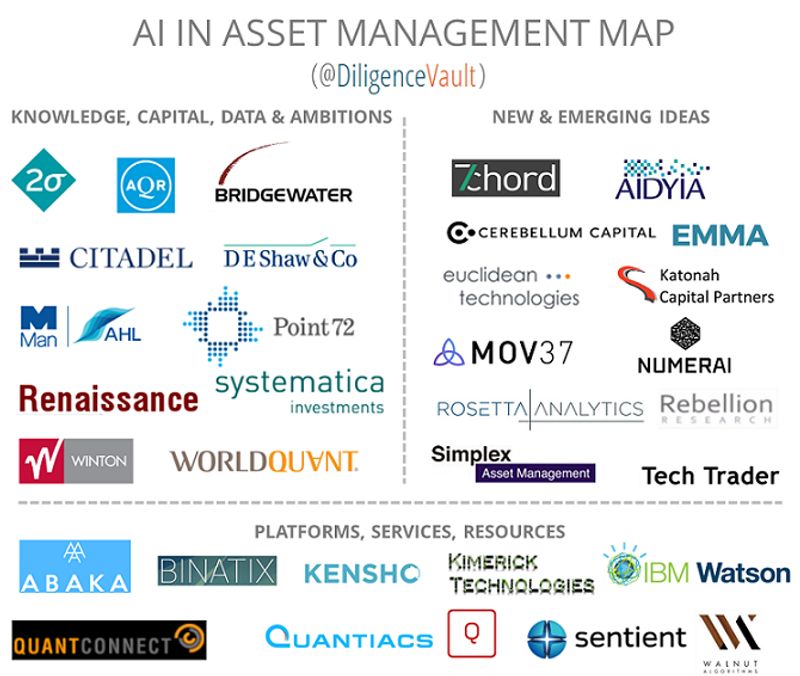

As asset management firms formulate a digital strategy, embrace automation, and drive artificially intelligent outcomes, new areas of focus are developed. We present a map of the leaders with capital, datasets and AI ambitions, and juxtapose these with new ideas, analytics and platforms.

With Opportunity Comes Responsibility

While the intrigue of finding new sources of alpha is tempting, it also brings up new and nuanced areas of diligence to address new risk factors. How can asset owners adapt their framework to the new paradigm inclusive of AI, and what questions should they ask?

-

Why AI?: Is the asset manager aware of and able to articulate their AI touch points? We classify these firms in three broad categories.

a. Data-driven firms: Firms leveraging AI in sourcing, cleaning, normalizing, and tagging large amounts of multi-dimensional datasets. Either identifying new sets of data, and/or processing existing data sets faster, and at a greater frequency.

b. Decision-driven firms: Firms leveraging AI to think like humans, influencing investment decision, portfolio construction and execution. These firms must possess the ability to spot risks in data-mining and unexplained outcomes.

c. Productivity-driven: Firms leveraging AI to improve infrastructure around investing, client engagement, adding efficiency to operations, and improving employee retention. These firms will gain a competitive advantage and will be poised to capture greater asset and fee share in the increasingly digital world vis-a-vis firms who are late adopters.

- Human capital: General abstraction of AI and intelligence is very difficult to achieve. On the other hand, vertical AI algorithms have been promising. So firms that want to be successful in this space must invest in human expertise along with data, and technology. Does the asset manager sport a combination of all three?

- Data strategy: Unlike the human propensity to learn from very few examples, supervised AI models require many data points to train. New data sets in addition to asset prices, economic and fundamental, can influence investment decisions. Is the asset manager equipped to handle large quantities of alternative data sets ranging from consumer credit, shipping information, satellite data, social media, and weather-related datasets? Or would they buy pre-processed datasets?

- Research focus: Even though AI has been around since the 1970s, most of the practical applications have been developed in the last few years. These applications remain research intensive and expensive. If an alpha opportunity wins, others will catch up. Asset owners will follow the winners, which will result in capacity constraints and the need for investment strategies to continue to evolve, as they always have. Firm size is a clear advantage in building research capabilities. However, crowdsourced AI platforms, and collaboration models have improved the ability to diversify this risk.

- Evidence: Past performance is no guarantee of future results. Even so, investors do need empirical evidence. With AI, the investment strategy and process has evolved with the addition of a new dimension: data, technology and risks associated with all things new. One needs to evaluate evidence within the risk framework of overfitting, crowding of ideas, and ability to learn, unlearn and re-learn. The psychological risk around the AI hype comprises unrealistic investor expectations, demanding 100% accuracy, and a no-fail strategy. The evidence focus needs to shift from historical number crunching to outcome-based analysis.

- Asset Allocation and Portfolio Fit: Is the AI investment impact meaningful within an investor’s portfolio? Will AI strategies support the scale required by most asset owners over an extended period of time?

Private Markets in Data Structuring Game

While all the buzz on AI is centered in liquid segments of the markets, private markets are a few steps behind. The current private market investing process involves deal sourcing, pouring through legal documents, and looking at portfolio metrics, which is all information heavy. Investing remains largely relationship driven and deal flow driven, not data driven (at least for now).

Success in New Ways

Will asset owners be able to participate in the AI value chain, from creation to application, and to build a diverse portfolio allocation?

Do they have the expertise and tools to execute diligence on these emerging public market themes, especially as the investment process evolves?

How will private markets adapt? Early adopters of AI will need to solve for the transition from unstructured to structuring data with a combination of NLP and industry context. Which private market firms will be leaders in building a repository of structured data? Perhaps partnership between the AI firms in public and private market will create a winning AI strategy? Two Sigma meets Blackstone in the US. Or Winton meets Partners Group across the pond?

Disclaimer: Author has participated in a Winton Labs accelerator program. The author has no knowledge of any partnerships between the firms named.