The five key use cases and best practices for building a tailored assessment framework, driving informed investment strategies, and fostering resilience over time.

We bring you 5 takeaways on operational risks in alternative investments from MFA Ops Los Angeles Conference 2024. A rich discussion between GPs and LPs.

Dive into the latest insights as DiligenceVault recaps top Operational Due Diligence (ODD) takeaways from Q1 2024, shedding light on the minds of industry professionals and key trends.

This paper delves into the organization of ODD teams, covering internal, outsourced, and co-sourced structures. The selection depends on fiduciary mandates, internal expertise, resource availability, and investment program complexities.

Discover how SEC enhances their regulation of private funds advisors with a set of new and amended rules. - What does it mean for DV clients?

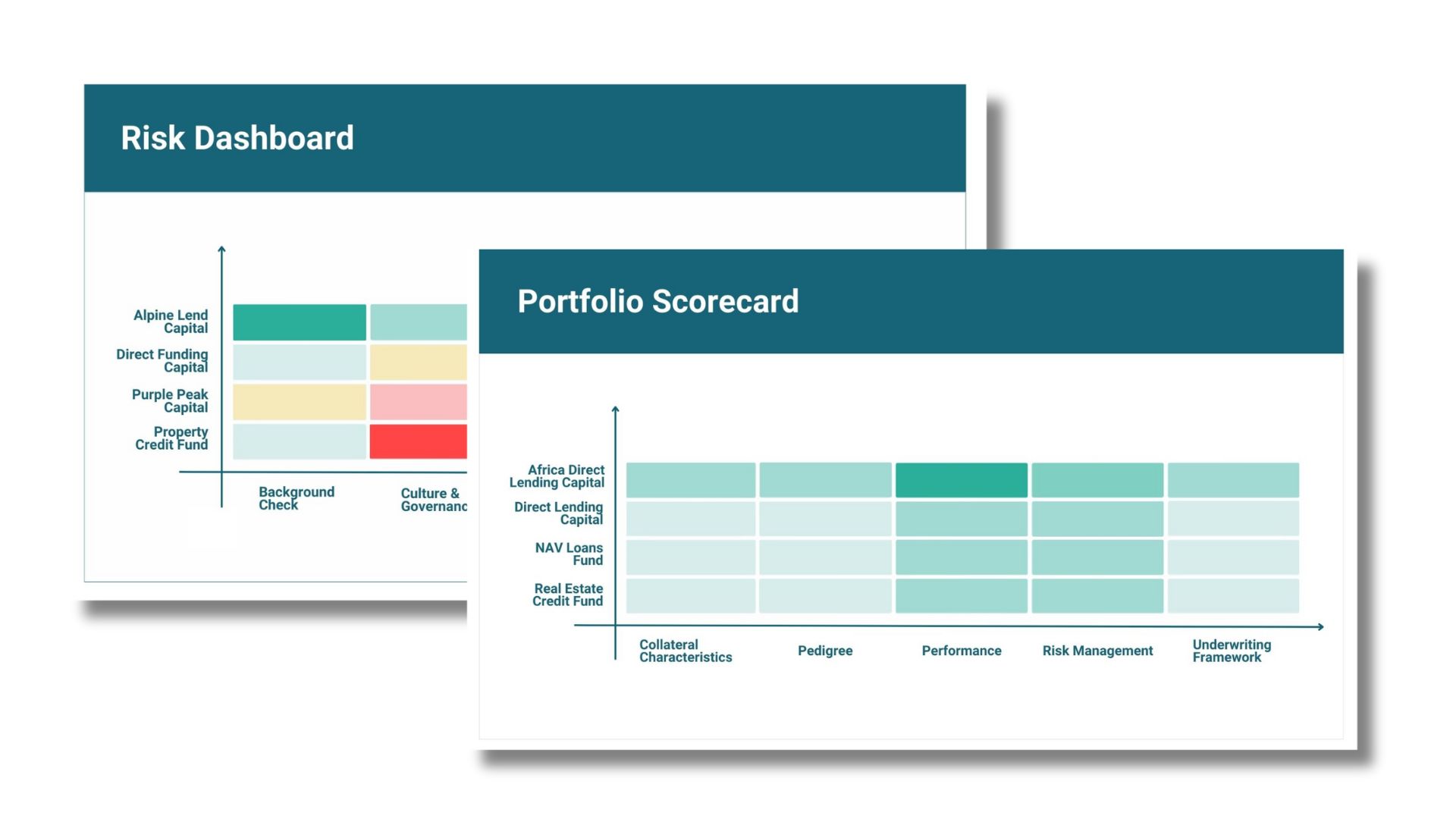

This whitepaper explore the maturity of the various Operational Due Diligence programs, the various data sources leveraged by ODD teams, and how they are integrating their judgement and expertise with...

In this blog we highlight the five key takeaways from our recent discussion with over 40 clients and industry experts, on all that you need to know about background check.

8 takeaways for allocators and fund managers including operational due diligence, Asia and technology innovation

Have you ever wondered if you could just cook up a new career opportunity in your kitchen? We bring you the right...