Discover key takeaways and insights from our Chicago ODD Roundtable focused on AI, outsourcing, cybersecurity, ODD team talent, reporting trends, and regulatory shifts.

Catch up on the most talked-about ODD trends from Q2 2025, straight from our conversations with 22 industry peers at the NYC Roundtables.

Read the key takeaways from our webinar on when generative AI meets documents: unlocking the magic of intelligence, efficiency, and due diligence at scale

Read the blog and explore the key operational due diligence trends for 2025, featuring insights on AI, cybersecurity, ESG, and vendor risk management.

Read the takeaways and insights from our team who recently attended the GAIM Ops West 2024 in Carlsbad, CA.

Which are the top industry DDQs? Which ad hoc and market driven events need rapid data collection and surveys? Refer our most recent blog as you build out your due...

Read about the top 9 trends in Operational Due Diligence (ODD) from Q2 2024, as discussed with industry peers at our latest NYC Roundtable.

Read the takeaways and watch the on-demand replay of our webinar 'Operational Due Diligence For Multi-Asset Portfolios.' focused on the various ODD trends, insights and best practices for multi-asset portfolios.

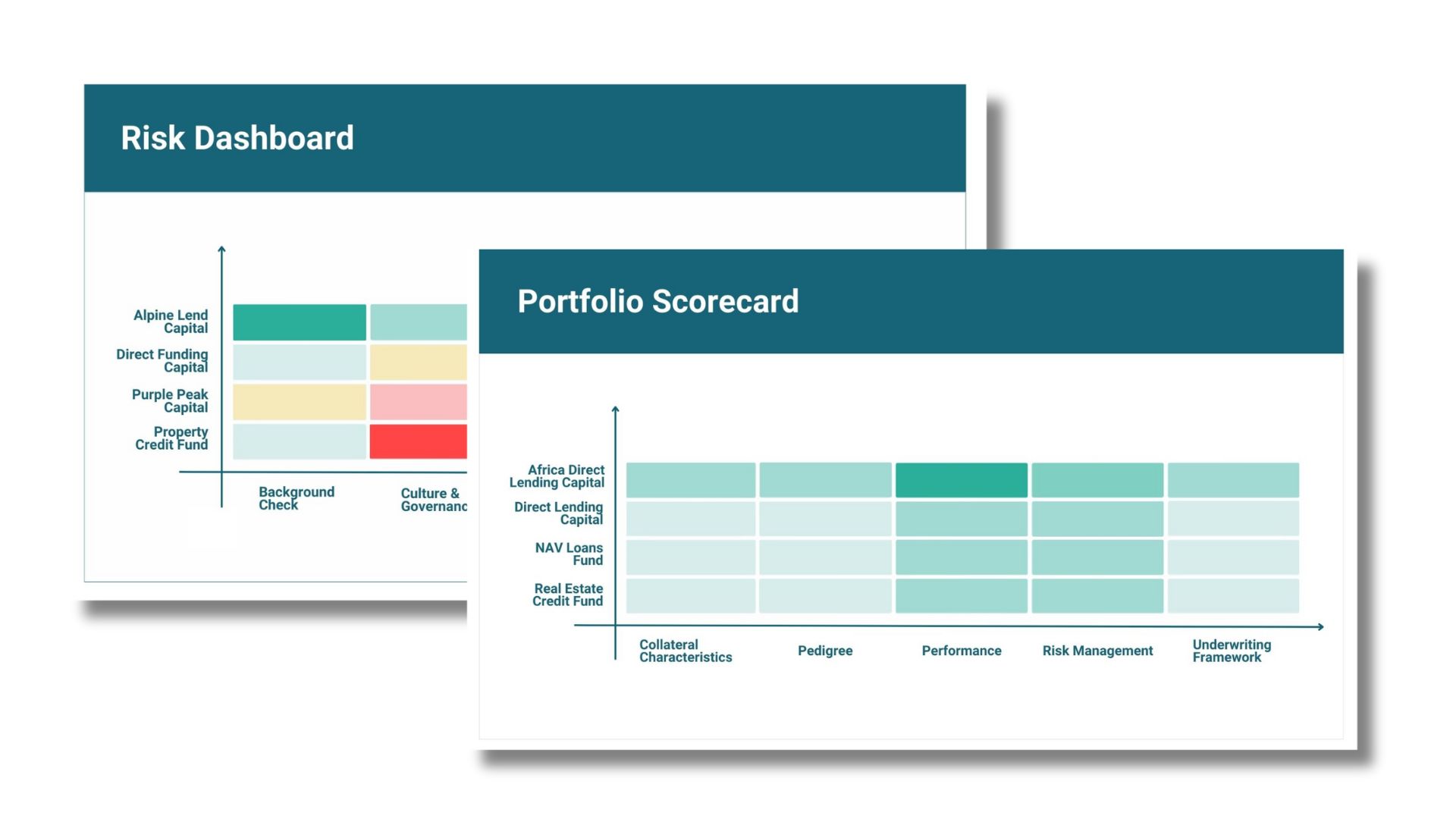

The five key use cases and best practices for building a tailored assessment framework, driving informed investment strategies, and fostering resilience over time.

We bring you 5 takeaways on operational risks in alternative investments from MFA Ops Los Angeles Conference 2024. A rich discussion between GPs and LPs.